Maximizing Real Estate Returns

The Profit First Method and Baselane Banking

Managing your finances as a real estate investor can be a challenge. The frustration of seeing your money come in one day only to go out the next, compounded by uncontrollable factors like rising insurance and utility rates, can leave you feeling stressed and out of control.

One way to gain back control over your expenses is to adapt the Profit First method for real estate. Instead of the conventional formula where sales – expenses = profit, the Profit First method ensures profit is prioritized and expenses are controlled using the formula sales – profit = expenses.

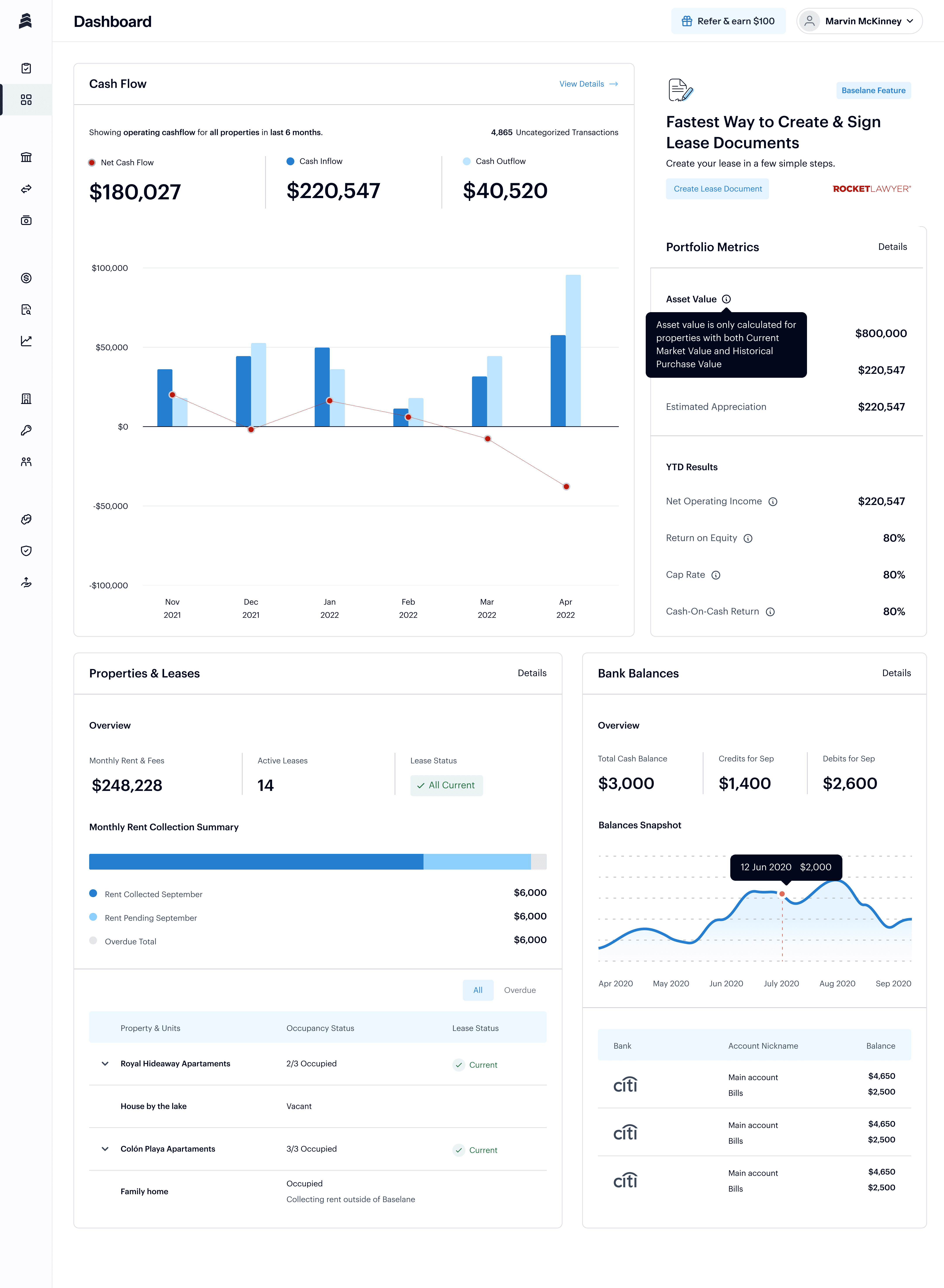

The Profit First method should be implemented with a banking system built for real estate investors, such as Baselane Banking. Baselane allows you to create multiple virtual banking accounts which helps you truly implement the Profit First method and helps you earn and keep more profits.

Section 1: Understanding the Profit First Method

The Profit First system was established by Mike Michalowicz and later adapted by David Richter to specifically address how real estate investors can use Michalowicz’s system. David Richter’s book, Profit First for Real Estate Investing guides investors on how to create, manage, and grow wealth by implementing a cash flow management system.

Traditional accounting methods often leave profit as an afterthought, leading to reactive financial management. In contrast, Profit First emphasizes proactive profit allocation and disciplined expense management. Rather than spending the profit you’re receiving from your investments on a whim, you start by setting a profit margin you feel comfortable with.

Richter recommends basing the profit percentage on your Real Revenue which is your Total Rental Income minus Mortgage, Interest, Taxes and Insurance. The higher your Real Revenue the higher percentage you can allocate for Profit.

|

Real Revenue Range |

$0-$250K |

$250K-$500K |

$500K-$1M |

$1M-$5M |

$5M-$10M |

$10M-$50M |

|

Profit |

10% |

15% |

20% |

15% |

20% |

25% |

Let’s apply Richter’s formula to 3 rental units that combined produce $45,000 in annual Rental Revenue. In this example, Mortgage, Interest, Taxes, and Insurance amount to $33,750/yr. That leaves the rental owner with $11,250/yr of Real Revenue. The Real Revenue is then separated into 5 categories: 1) Profit; 2) Owner’s Pay; 3) Owner’s Tax; 4) Operating Expenses; and 5) Repairs, Vacancy, and Turnover.

Since in this example the Real Revenue is less than $250,000, Richter recommends allocating 10% of it to Profit which comes out to $1,125/yr.

Next is setting Owner’s Pay. Afterall, you should also be compensating yourself for your time managing the rental. This percentage varies based on the amount of Real Revenue as well:

|

Real Revenue Range |

$0-$250K |

$250K-$500K |

$500K-$1M |

$1M-$5M |

$5M-$10M |

$10M-$50M |

|

Owner’s Pay |

40% |

30% |

15% |

10% |

5% |

0% |

Since the Real Revenue is less than $250,000, Richter recommends allocating 40% to Owner’s Pay which comes out to $4,500/yr.

Operating Expenses also vary based on Real Revenue. As Real Revenue increases so do Operating Expenses. Here are Richter’s recommended percentages for Real Revenue ranges:

|

Real Revenue Range |

$0-$250K |

$250K-$500K |

$500K-$1M |

$1M-$5M |

$5M-$10M |

$10M-$50M |

|

Operating Expenses |

30% |

35% |

45% |

55% |

55% |

55% |

In this example Operating Expenses are set at 30% of Real Revenue or $3,375.

Owner’s Tax is set to 5% of Real Revenue regardless of the amount of Real Revenue, so in this example $563 of Real Revenue goes to Owner’s Tax.

In addition, repairs, Vacancy, and Turnover are set to 15% of Real Revenue. This percentage also remains the same regardless of the amount of Real Revenue, so in this example it’s $1,688/yr.

Separating your Real Revenue into these 5 categories is best accomplished by using 5 separate bank accounts. This would essentially look like:

|

Average Monthly rents |

$1,250 |

|

|

Total Rental Income (Annual) |

$45,000 |

|

|

PITI (Mortgage, Interest, Taxes, Insurance) |

$33,750 |

|

|

Real Revenue (annual) |

$11,250 |

|

|

Banking Account #1 |

Profit |

$1,125 |

|

Banking Account #2 |

Owner’s Pay |

$4,500 |

|

Banking Account #3 |

Owner’s Tax |

$563 |

|

Banking Account #4 |

Operating Expenses |

$3,375 |

|

Banking Account #5 |

Repairs, Vacancy, Turnover |

$1,688 |

By separating your Real Revenue into 5 separate accounts, you will have enough set aside for an unexpected maintenance issue or vacancy.

Below is a summary of the percentages Richter Recommends for each category based on the Real Revenue Range.

|

Real Revenue Range |

$0-$250K |

$250K-$500K |

$500K-$1M |

$1M-$5M |

$5M-$10M |

$10M-$50M |

|

Real Revenue |

100% |

100% |

100% |

100% |

100% |

100% |

|

Profit |

10% |

15% |

20% |

15% |

20% |

25% |

|

Owner’s Pay |

40% |

30% |

15% |

10% |

5% |

0% |

|

Owner’s Tax |

5% |

5% |

5% |

5% |

5% |

5% |

|

Operating Expenses |

30% |

35% |

45% |

55% |

55% |

55% |

|

Repairs, Vacancy, Turnover |

15% |

15% |

15% |

15% |

15% |

15% |

Note that these allocations can be adjusted based on your rental business’s specific financial dynamics and goals. The idea is to create a sustainable financial model that reduces stress and improves financial management.

Whether it’s a rental or other type of business, businesses that adopt this method often see reduced debt, increased savings, and more strategic growth.

Section 2: Why Real Estate Investors Need a Unique Financial Approach

Real estate investors often encounter irregular cash flows due to vacancies or tenants who don’t pay rent, no matter how good they are at screening tenants. Unexpected maintenance costs and operational expenses can also present challenges. For example, some rental owners have reported an unexpected insurance rate increase as high as 150% in the last year due to the insurance market crisis.

Real estate investors often encounter irregular cash flows due to vacancies or tenants who don’t pay rent, no matter how good they are at screening tenants. Unexpected maintenance costs and operational expenses can also present challenges. For example, some rental owners have reported an unexpected insurance rate increase as high as 150% in the last year due to the insurance market crisis.

Furthermore, you may want to invest in strategic capital expenditures like renovations or smart home technology. These strategic investments may pay off in the long term, but if you don’t know how much you can afford to spend, you may complicate your finances in the short term.

Another critical aspect for real estate investors is portfolio growth. Knowing when you can buy your next property is a key question. If you do not have clear picture of your current financial position, you might miss opportunities for growth or, conversely, overextend yourself and risk financial instability.

The Profit First method helps you confidently make intelligent investing decisions and enforces disciplined expense management. With this method you’ll have less financial stress and enhanced decision making, knowing you have enough set aside for taxes, repairs, and other critical expenses.

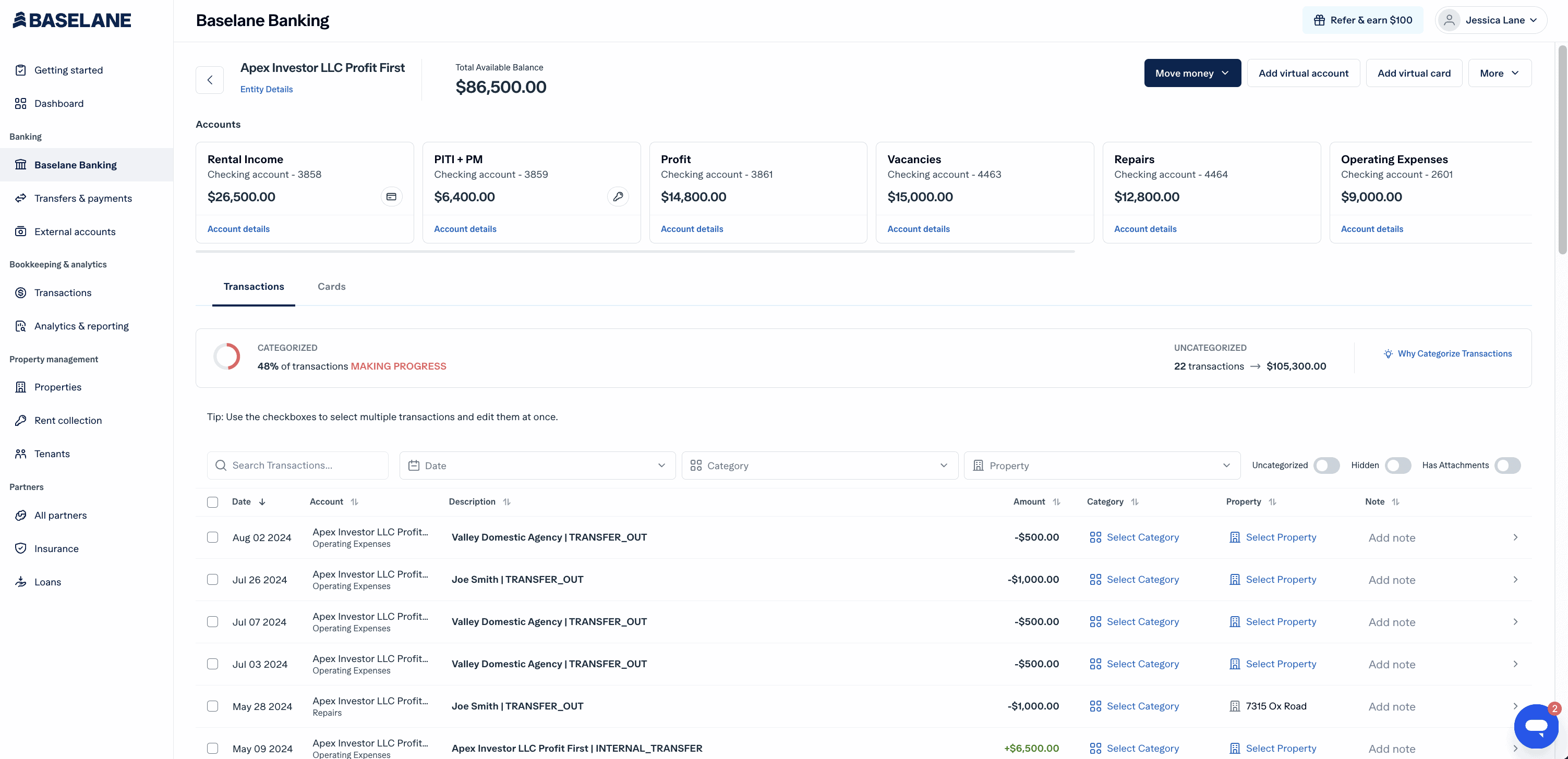

Section 3: Baselane Banking helps you implement The Profit First Method

Baselane Banking is designed specifically for real estate investors and provides you with multiple bank accounts you need to implement David Richter’s recommendations. Unlike traditional banking, Baselane’s Banking allows investors to create specialized banking accounts that can be used to implement the Profit First method, automated accounting and bookkeeping features, and integration with other financial tools and platforms. The cherry on top is an exceptionally high annual percentage yield (60 times the national average) and no fees or minimums to use Baselane Banking.

Specialized Accounts

Specialized Accounts

With Baselane Banking, you can create an unlimited number of checking and savings banking accounts for specific properties and purposes, such as security deposits, profit allocation, tax savings, and operating expenses. These capabilities align perfectly with the Profit First method and allow you to gain more visibility into your finances and expense management for each of your rental properties.

When receive rental income and pay your Mortgage, Interest, Taxes and Insurance you can take the remaining Real Revenue and split it up into the accounts you’ve created. The best part about using Baselane banking is that you can establish a different Operating Expense account for each rental property or building you own.

If an emergency maintenance issue arises you can pay for it directly from the Operating Expenses account. If you’re using the Profit First method and have also set 10% of your income to go towards the Profit account and 40% to go towards the Pay account, then you’ll feel less stressed knowing there are sufficient funds to cover the maintenance issue and still pay yourself and remain profitable.

Automated Accounting and Bookkeeping

When using Baselane’s free online rent collection and accounting tools, every transaction related to your rental is automatically categorized, reducing the time and effort to manage financial records and create your Schedule E at tax time. If you’ve used the Profit First method to deposit 15% of rental income into a Tax Savings account, then you’ll also be prepared to pay your taxes when the time comes.

Baselane also seamlessly integrates with Quickbooks, Venmo, AirBnb, and several other platforms so you can accurately manage everything from one place. Rather than consolidating information from several platforms manually, they can all be visible in Baselane. This integration enhances the efficiency of financial operations and supports strategic decision-making.

High APY and Cash Back

High APY and Cash Back

Make the most of the money sitting in your accounts with a high APY and no account fees or minimums. That’s found money you can use in your Profit First Method. This applies to all investors regardless of the entity type or number of units under management.

Spend Controls

Effortlessly manage your expenses with free ACH with a Baselane banking account and wire transfers. Send payments, pay invoices, make transfers, and manage checks from any device with ease. You can also set custom spend controls on Baselane’s virtual or physical debit cards, so you and your team are spending only what is within your set parameters.

Conclusion

By leveraging the Profit First method within the Baselane Banking ecosystem, real estate investors can simplify their finances and boost profitability. This combination makes managing property investments easier and more efficient. With clear profit allocation and advanced financial tools, investors can handle market challenges and seize opportunities with confidence. You can start implementing these strategies by visiting Baselane.com and opening up a free account.

Disclaimer: The Annual Percentage Yield (APY) on your account is accurate as of 04/05/23. Accounts with balances less than $10,000 earn 1.95% APY. Accounts with balances between $10,000 and $24,999 earn 2.93% APY. Accounts with balances between $25,000 and $49,999 earn 3.40% APY. Accounts with balances of $50,000 or more earn 4.19% APY. These are variable rates and are subject to change based on the target range of the Federal Funds rate. There are no minimum balances or minimum deposits required to earn interest on your account. Review the Baselane Business Deposit Account Agreement for more information.

Accessibility

Accessibility