Unsold homes are turning into rentals

Accidental Landlords Add Pressure to Single-Family Rental Market

KEY TAKEAWAYS

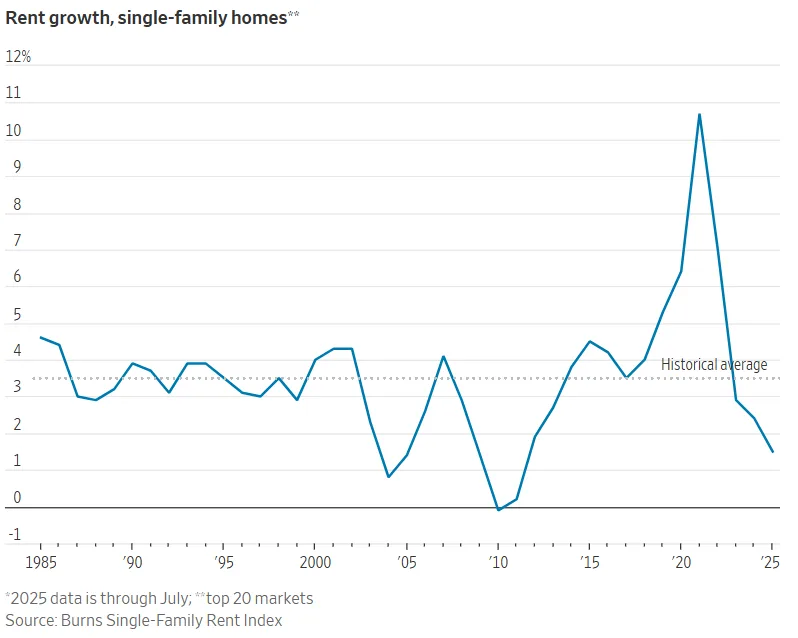

- A surge in unsold homes converted to rentals is slowing rent growth, with projections showing just a 0.8% increase in 2025, the weakest since 2011.

- Sunbelt cities like Dallas, Tampa, and Phoenix are seeing rental supply rise sharply as homeowners struggle to sell.

- Major landlords like Invitation Homes are offsetting weak new lease rents by raising rates for existing tenants, risking future turnover.

- Institutional investors heavily exposed to overbuilt markets are seeing underperformance as rental competition grows.

Shift in Supply

An unexpected trend is reshaping the SFR market: sellers who can’t offload their homes are renting them out instead, per WSJ.

These so-called “accidental landlords” are adding supply to a rental segment that had been strong for institutional investors.

This summer, 2.3% of homes listed for sale were switched to rentals, with that share climbing above 5% in several Sunbelt markets. The effect is most visible in cities like Dallas and Tampa, where for-sale inventory rose 25% and 39%, respectively, compared to August 2019.

Rent Growth Slowing

Though SFR portfolios still report high occupancy and strong retention, rent growth is stalling.

John Burns Research & Consulting expects rents to rise just 0.8% this year across the top 20 markets. That’s the weakest growth in more than a decade.

Operators like Invitation Homes and American Homes 4 Rent are already seeing rent declines on new leases in oversupplied markets such as Tampa, Orlando, and Dallas.

To offset the drop, many are raising rents on existing tenants. In South Florida, Invitation Homes hiked in-place rents by 6.2% in 2025, even while offering discounts to new renters. But this gap could lead more tenants to leave when their leases end.

Get a Free Multifamily Loan Quote

Access Non-Recourse, 10+ Year Fixed, 30-Year Amortization

Investor Risk

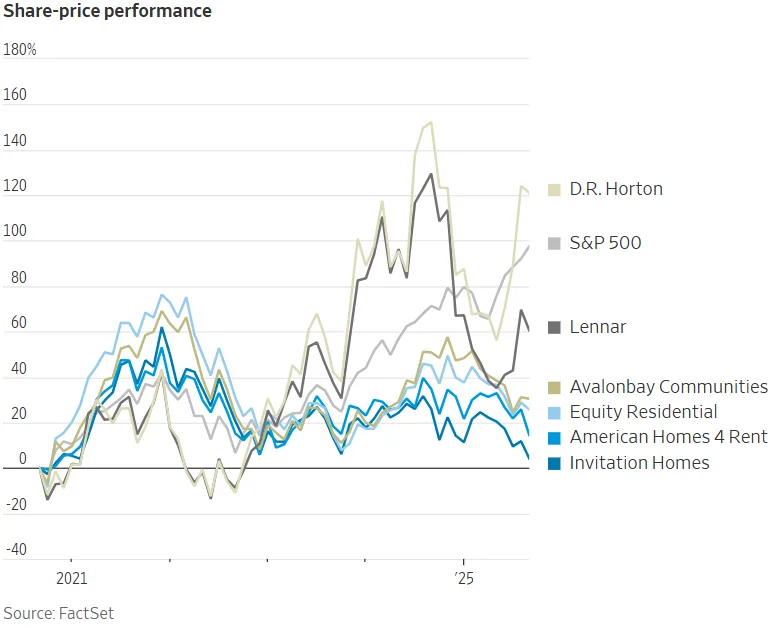

Institutional landlords heavily exposed to oversupplied markets are feeling the squeeze.

According to Parcl Labs, over one-third of institutional SFR portfolios are located in just six cities. Many of these markets are now grappling with higher inventory and softer rents.

That’s shaking investor confidence. Major SFR landlord stocks are underperforming the broader market and lagging behind other real estate sectors like multifamily and homebuilding.

Market Stuck

Ironically, the best-case scenario for landlords may involve lower mortgage rates to help clear excess for-sale inventory. But that also risks losing tenants to homeownership, pushing up vacancies.

With home transactions now at their lowest level since the 1990s and unsold inventory spilling over into rentals, the SFR sector faces a rare headwind: too much housing supply in a market where both buyers and sellers are stuck.

What’s Next

Institutional investors will need to adapt to a more volatile rental market, especially in overbuilt Sunbelt metros. As accidental landlords add supply and mortgage conditions remain uncertain, expect greater pricing pressure, and rising tenant churn, across the SFR landscape.

Source: CRE Daily

Accessibility

Accessibility