Climate Risk Data Is Playing an Important Role in Investors’ Decision Making

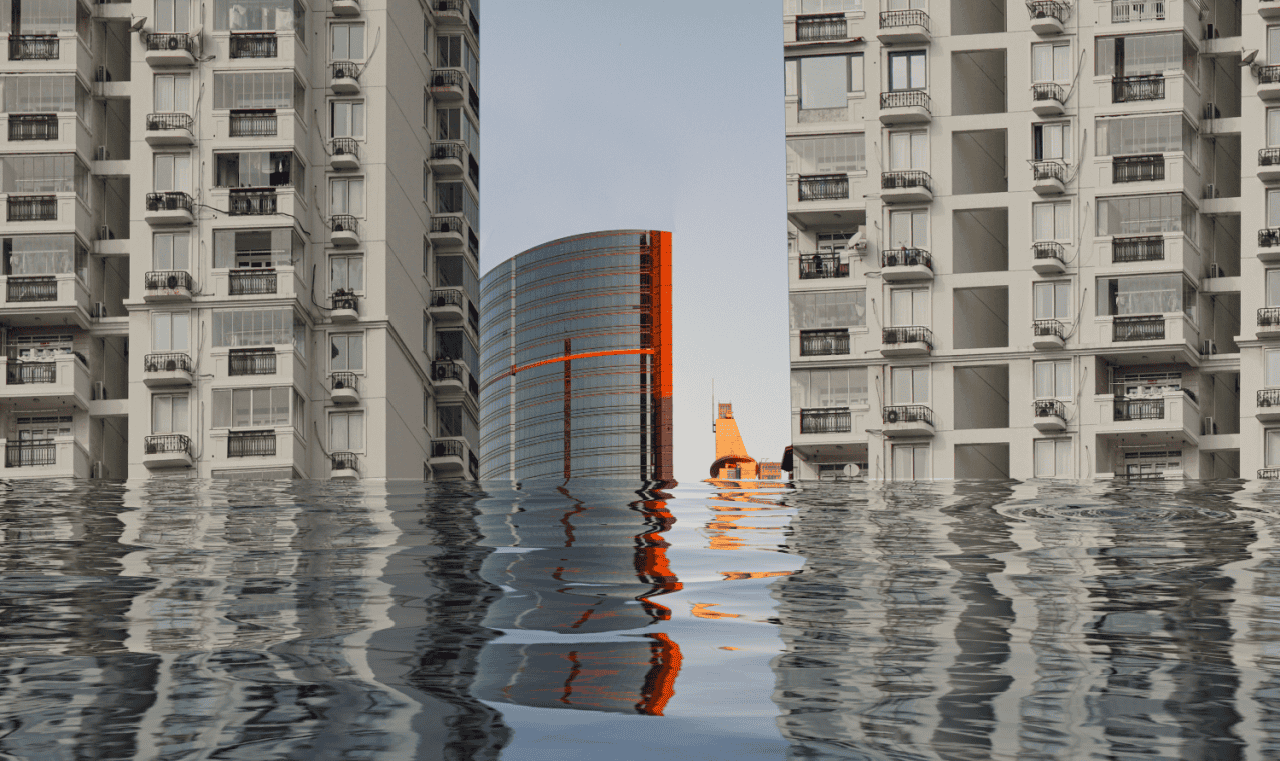

The U.S. once again finds itself grappling with the aftermath of a devastating hurricane, one of the many pummeling weather events that have caused death and destruction across several states in recent years. Climate change is exacerbating the size and scope of storms and floods, and more than ever, property owners and investors want more information about potential climate risks.

In the same school ratings, walkability scores, and property tax information are featured on residential and commercial property listing sites; climate risk data is now finding its way into the data set.

Last week, Zillow, the country’s largest real estate listings platform, announced it would soon begin adding climate risk scores to property listings. The data, which will be provided by the climate risk financial modeling company First Street, will span five categories: flood, wildfire, wind, heat, and air quality, alongside insurance recommendations.

Zillow leaders said the decision to add the new feature is meant to address the overwhelming majority of buyers who now consider climate risks when looking to purchase a home.

In early September, Zillow released new proprietary research that found that more than 80 percent of American home buyers consider climate risks like floods, wildfires, extreme temperatures, hurricanes, and drought when shopping for a new home.

“Climate risks are now a critical factor in home-buying decisions,” said Skylar Olsen, chief economist at Zillow. “Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions. As concerns about flooding, extreme temperatures, and wildfires grow—and what that might mean for future insurance costs—this tool also helps agents inform their clients in discussing climate risk, insurance, and long-term affordability.”

Before Zillow’s announcement, Realtor.com rolled out new climate risk factor scores on its website earlier this year using data from First Street as well. The new tools offer users a more in-depth look at fire and flood risks.

Commercial real estate is expanding its climate risk data offerings as well. Companies that provide ESG software for the commercial real estate industry are increasingly including tools that analyze physical climate risk data. Firms like Measurabl, CoreLogic, ClimateCheck, and CoStar have announced in recent years new tools and programs that incorporate data about things like flood risk, valuation data, and risk models that help better predict and measure the financial impact of potential future natural disasters.

A number of “climate intelligence” startups have emerged in recent years aimed at offering users predictive analytics platforms that can help companies better anticipate and prepare for extreme weather events. Many use AI and machine learning, and some, like One Concern, are developing digital twins to aid in modeling the impacts of climate change.

Paying Too Much For Insurance?

Get a FREE quote to insure your rental properties for less.

The urgency of gathering data on risk is becoming more clear. In 2022 alone, extreme weather events caused $313 billion in global economic losses, according to insurance broker Aon. The impact that climate risks have on a real estate portfolio is widespread.

Climate risks touch on several key components of a property: disastrous weather events impact the physical structure of a property and the appeal and desirability of a geographic market, energy efficiency impacts a property’s operational costs, and green ratings affect the marketability of a property and tenant demand.

Companies including IBM, Moody’s, and Blackrock now offer their clients climate risk analytics and insight services to help them make better-informed investment decisions and to aid in regulatory and disclosure reporting and portfolio decarbonization.

A report from the global management consulting firm McKinsey on climate risk and the real estate industry recommended that real estate players focus on three actions during this transitional time of focusing on climate issues: incorporate climate change risks into asset and portfolio valuations; decarbonize real estate assets and portfolio; and create new sources of value and revenue streams for investors, tenants, and communities.

A thorough climate risk analysis will consider a broad range of environmental data to measure how climate change and sustainable building practices can impact a property’s performance, according to JLL. That can also include taking into account the frequency of natural disasters, rising temperatures, air quality, and sea level rise.

As the number of extreme weather events has increased, valuation and risk experts have stepped up climate risk analysis efforts to incorporate the latest and most relevant data. “The data has to evolve so that an investor can see the changes in risk over time and the impact on value,” said Tyrone Hodge, Global Head of Risk Advisory at JLL. “We are analyzing multiple sources of climate and property data to construct our own method and provide timely insights to investors.”

All of this movement on climate risk data is helping bring more transparency to the business and, hopefully, helping buyers and sellers of real estate make more informed decisions. Software companies using machine learning and AI in climate risk modeling continue to emerge, and more consulting and investment management firms are now offering climate risk analysis and insight to their clients.

But while a lot of the valuable insight and data now offered to real estate investors comes at a price, including climate risk data in publicly available property listings goes even further, providing an important tool for buyers and sellers right at the ground floor and cementing climate risk data as one of the primary factors in decision making.

Source: Propmodo

Accessibility

Accessibility