What Can I Deduct or Withhold From a Security Deposit?

The rules for handling and deducting from a security deposit are commonly misunderstood. This article will clarify the legitimate reasons for withholding all or part of a security deposit from a tenant.

Best Practices for Withholding a Security Deposit

It’s a common scenario: your tenant pays you a security deposit before moving in, which gives you some peace of mind that the money will pay for certain items or damages when the tenant moves out.

When move-out day arrives, the tenant says they left the unit spotless, but the floor wasn’t even swept. Or worse, there are broken windows, an unidentifiable sticky liquid all over the fridge, and a clogged shower.

The general rule is that a landlord or manager can only withhold deposit monies for actual damages, material or financial. Meaning, you can deduct money if they owe you past due rent and fees, or caused damages beyond normal wear-and-tear.

State laws vary greatly, but there are generally some statues that regulate the basics such as:

- whether or not you must put the money into an interest-bearing account,

- if you can or cannot commingle such deposits with your personal or business accounts

- what you can or can’t deduct from a tenant’s security deposit

- the timeframe in which you must return the deposit or supply written notice of why you aren’t returning all or part of it.

Things to Remember:

- Always fill out an “Inventory/Condition Checklist” before the tenant moves-in so that there is a baseline for comparison.

- Provide the tenant with an itemized receipt of any deductions before returning any money.

- Take plenty of pictures of the damages and overall condition after each move-out.

- Follow your state’s rules and timelines for returning the deposit.

Let’s talk about some basic general rules for deducting and withholding deposits.

Breaking the Lease

You can’t automatically keep a deposit just because your tenant abandons the lease or breaks a rule in it. Again, you must have actual damages to offset your claims against the deposit.

If the tenant leaves you high and dry with unpaid rent, utility bills, late fees, and parking fees, then you could withhold some or all of the deposit to cover the debt. A lease is a contract, and if the tenant breaches it, you can take them to court if they don’t pay.

Practically speaking, unless the debt is multiple thousands of dollars, going to court is often more trouble than it’s worth. Even if you receive a judgment, you still have to collect it from the former tenant. Most landlords opt to keep the security deposit and look for a suitable new tenant.

Abandonment and Unpaid Rent

If the tenant abandons the lease and stops paying rent, you almost certainly will have a claim because it takes a few weeks, if not months, to find a replacement tenant. Your previous tenant would still be responsible for rent during that time, and if he/she didn’t pay, then you could withhold the deposit to offset the unpaid rent, and sue them for any remaining balance.

Note: if you keep a month’s worth of rent from the deposit, but don’t actually have a vacancy that is a month-long, then you would need to give back any overlapping funds.

Since most security deposits cover only one or two month’s rent, it’s important to start eviction proceedings as soon as possible if the tenant makes no attempt to pay.

If you’re not familiar with the eviction process in your area, hiring an attorney is wise. It’s not okay for the tenant to forego paying the final month’s rent under the assumption you’ll apply the security deposit to it – so don’t use the deposit for last month’s rent.

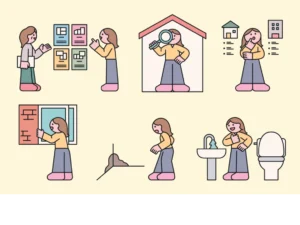

Normal Wear and Tear

Every property suffers some normal wear and tear, and you can’t deduct that basic upkeep from the security deposit. If the tenant cleans regularly, then the landlord is always responsible for normal wear and tear.

The general rule of thumb is that a landlord is not allowed to deduct from the tenant’s security deposit for “normal wear and tear”.

Normal wear and tear typically includes the following:

- General rug wear

- Sun-faded wallpaper or paint

- Nail holes in walls from picture hangings

- Bathroom mirror desilvering

- Appliances no longer working, but not due to misuse

- Warped windows or doors, due to temperature or age

- Dirty draperies or blinds

Texas, as well as other states, define “normal wear and tear” as:

“…deterioration that results from the intended use of a dwelling…but term does not include deterioration that results from negligence, carelessness, accident or abuse of the premises, equipment or personal property by the tenant, by a member of the tenant’s household or by a guest of the tenant.”

Meaning, if a tenant was simply living in the property the way it was intended, and did not damage anything by means of abuse, negligence, accident, guests, animals, or lack of normal cleaning, then a landlord has no right to any deposit deductions. Since HUD doesn’t have an official list of acceptable deductions, landlords have to go by their state rules (if any exist), personal experience, and their gut feeling.

Property Damage

If your tenant or their guests cause excessive damage to the property, you can use the security deposit toward repair or replacement. Some damage is fairly obvious, such as big holes in the wall or floor, or broken fixtures. Other conditions, not so immediately apparent, are also deductible from the security deposit.

These could include but not limited to:

- Missing smoke or carbon monoxide detectors

- Flea extermination, if a pet lived on the premises

- Broken or missing window blinds

- Appliances broken due to negligence.

- Dirt and filth as a result of in adequate clean

- Any damages caused by lack of common sense or improper use (like sliding down a stair handrail)

Even if you find some excessive damage after the deposit was returned, you can still send an invoice to the tenant. However, the chances of receiving that money is slim to none.

Cleaning

If you have to pick up and dispose of a few minor items after the tenant is gone, that’s not grounds to withhold part of the security deposit. And quite honestly, it’s just not worth the effort to deduct money for a few items. However, if the tenant left junk and trash all over the place, or food rotting in the fridge, that’s a different story.

Many leases specify that a tenant should leave the property in “broom clean condition,” or terms to that effect.

I’ve never really liked this term because a tenant could potentially sweep the apartment, but leave the stove, fridge, and closets a complete mess. Without more specific language in the lease, you’ll eventually regret using the term “broom clean”.

Painting

Many landlords repaint the interior of the rental property to attract a new tenant. It’s routine and usually performed every few years, so you can’t deduct the costs of hiring a painter or purchasing paint from the security deposit.

However, if the tenant painted the walls some hideous shade or drew “art” on them, the cost of repainting is deductible – but only for the affected rooms. The same holds true if the repainting is necessary because the tenant or guests smoked in the dwelling, causing staining on the walls.

Likewise, if the tenant painted without your permission (lease clause required), you would be able to deduct the cost of a painter and supplies to return the wall to its original color compared to when they moved in. Although, if the paint color is neutral and nicely executed, then you might want to consider thanking your tenant for painting!

Provide Receipts

Make sure to document all the necessary repair work to prove your expenses. In most states, such documentation is required above a fairly nominal monetary amount ($126 in California).

If you deducted money and the funds are unsubstantiated, the tenant may take you to small claims court. Many times, the tenant can be awarded 2-3 times the deposit amount if you wrongfully withheld anything.

Source: landlordology.com

Accessibility

Accessibility