Home·Property Management·Managing Occupancy in the Off Season to Maximize NOI

During the winter it is much harder to attract new tenants

Managing Occupancy in the Off Season to Maximize NOI

|

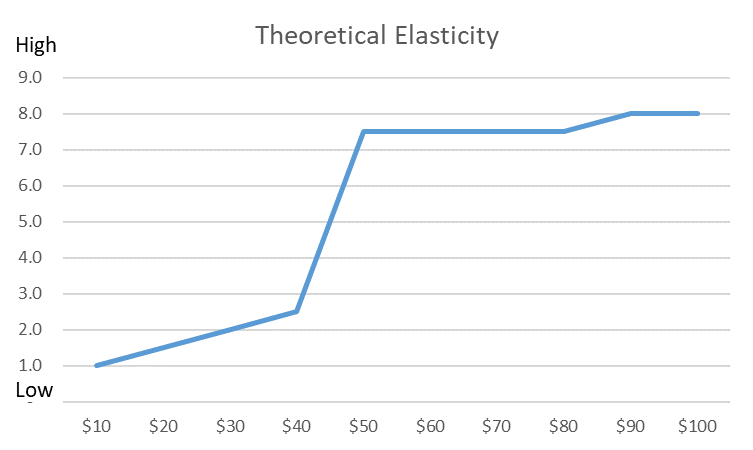

There is a fine line between growing rental income and creating vacancy that needs to be understood when managing a property. Economists describe this tension as “Price Elasticity of Demand”. It is a measure of the shift in demand for a product or service when a change occurs in one of the variables that buyers consider as part of their purchase decision. A product is “elastic” if consumers will change their purchase decision when, for instance, the price goes up. Inelastic is the opposite; think of the iPhone. Price doesn’t seem to affect the purchase decision. All products and services can have different price elasticity. For the apartment rental business, price changes can have a direct impact on attracting and maintaining tenants. Due to the inconvenience of moving, our business is definitely less elastic than, for instance, the purchase of eggs, but there is a point where price increases will lead to more vacancies, especially during the slow winter leasing season. The seasonality of the rental market has returned after a brief respite driven by Covid. Now, during the winter it is much harder to attract new tenants, so it is critical for management to have their finger on the pulse of the market and avoid creating vacancy through pricing. Another challenge in many areas of the country is increased supply. In Q3 2023, we saw the largest number of new apartment deliveries since the 1980s with over 400K units opening up for lease, and this will continue into 2024. New builds have been deploying aggressive pricing on lease ups, leading to a rental decline in some areas like Austin and Phoenix (-4%). Again, apartment managers need to be aware of the changing rental market and seasonality of demand when making pricing decisions on new leases and renewals. Need a Lease Agreement?Access 150+ state-specific legal landlord forms, including a lease. It is useful to look at the math behind the theoretical effect of price elasticity on apartment rentals. For every apartment rental situation there is a relationship between price increases and vacancy depending on the micro-economic factors in the surrounding area. In the graph below you can see that rent increases up to $40 a month have very little impact on tenants choosing to leave due to price, but at $50 something changes drastically. Every apartment manager needs to carefully monitor where they can move rents without triggering a mass exodus. |

|

|

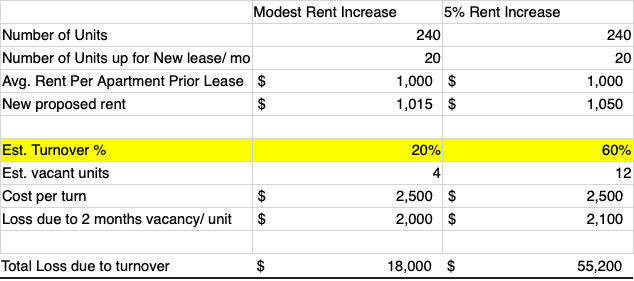

If, for example, the above elasticity existed for a 240-unit apartment complex, we can estimate the excess cost of going too far on rent increases. If in January, the manager had two options: renew with a modest increase of $15 versus a more aggressive $50. Due to the elasticity of demand, the cost of turning the units increases significantly once you cross that threshold. The other factor not considered here is the cost of persistent lower occupancy levels potentially created by having uncompetitive pricing. |

|

|

The old saying, “there is a time to reap and a time to sow”, is applicable here. During the slow leasing months, in some cases it is critical to tamp down rental increases to encourage tenants to stay and avoid a loss in net operating income. Another strategy used by successful managers is “expiration management”. That is where you intentionally move lease expiration dates to times of the year that are advantageous for acquiring new tenants at higher rent levels. One strategy is to avoid a large number of leases expiring during the slow winter season. Understanding all these factors and having a plan are the fine management nuances that can make a material difference in growing NOI and ultimately the property’s value. Source: Rod Khleif |

Get AAOA's Newsletter

Property Management News Categories

- Affordable Housing

- Collections

- COVID-19

- Eviction

- Fair Housing

- Financing

- Going Green

- Government

- Investing

- Landlord Forms

- Landlord Quick Tips

- Latest News

- Leasing

- Legal Brief

- Legal News

- Maintenance

- Make Extra Money

- Marketing Vacant Units

- Property Management

- Real Estate Investing

- Real Estate Trends

- Remodel and Repair

- Rent Magazine

- Security Deposit Alternatives

- Social Media

- Tax Tips

- Technology

- Tenant Screening

- Uncategorized

Accessibility

Accessibility