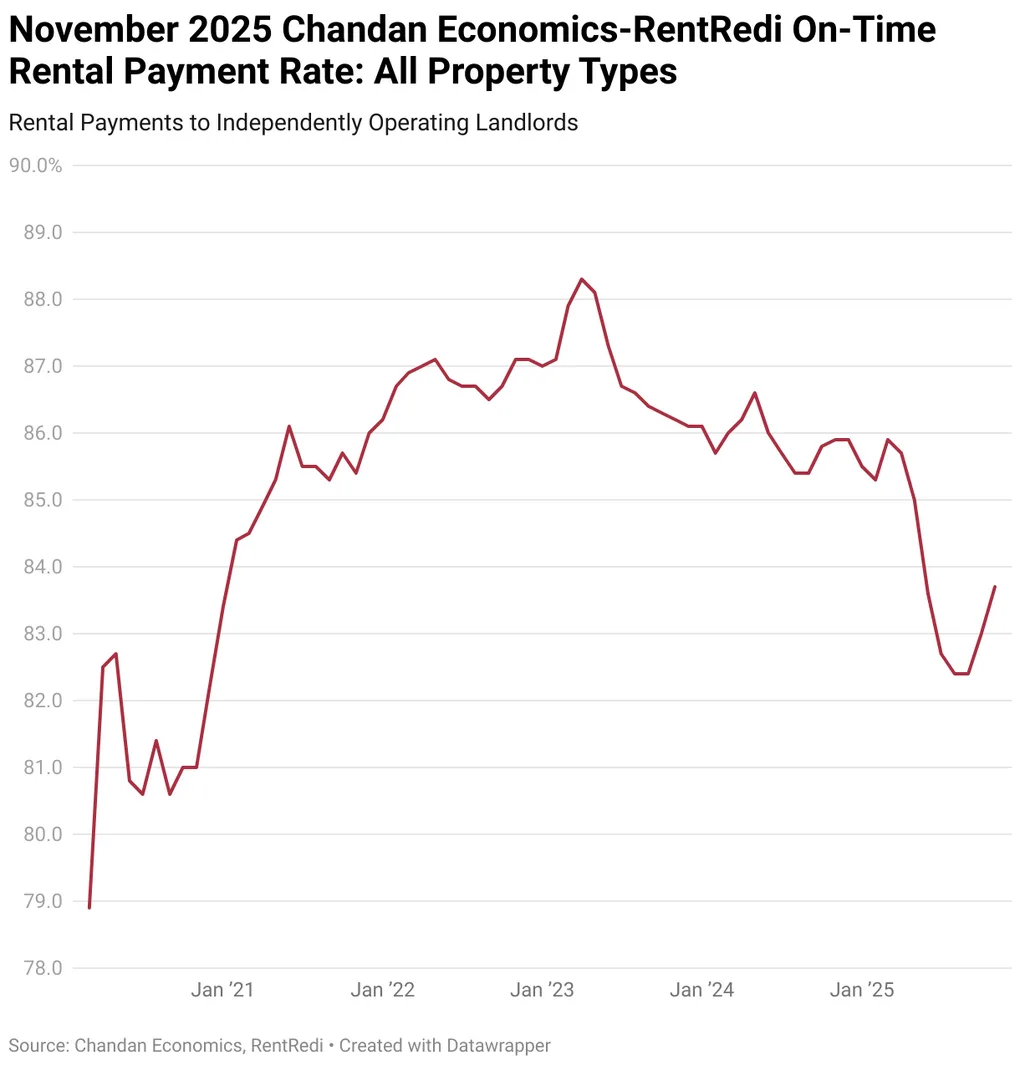

On-time rent payments rose to 83.7%

Mom-and-Pop Rent Payments Improve in November

KEY TAKEAWAYS

- On-time rent payments rose to 83.7% in November, marking a third straight month of improvement.

- Full-payment rates remain strong in 2025, averaging 96.1% despite higher late payments.

- Smaller 2–4-unit rentals outperformed other property types with the highest on-time collection rate.

A Gradual Recovery Underway

November marked a third consecutive month of gains in on-time rent collections for mom-and-pop landlords, reaching 83.7%. That’s up 65 basis points from October and 130 bps above the recent low recorded in August, according to Chandan Economics. While performance remains well below pre-pandemic highs, the latest figures suggest a modest rebound is beginning to take shape.

However, on-time payment rates are still trending lower on a year-over-year basis — a streak that has now stretched to 28 months. But recent data indicates the year-over-year gap is narrowing, offering cautious optimism for landlords heading into 2026.

Tenants Are Still Paying — Eventually

Despite the persistent drag of late payments, tenants are continuing to make good on their rent obligations. The full-payment rate — which includes on-time and late payments — has averaged 96.1% so far in 2025, outpacing 2024’s full-year average. While the November forecast dipped slightly to 94.9%, recent months have shown better-than-expected payment resolution rates.

This suggests that even as affordability challenges persist, most renters still prioritize keeping up with housing costs, even if behind schedule.

Report Your Tenant’s Rent Today!

Report on-time & missed payments to Experian, Equifax, and TransUnion

Late Payments: A Persistent Challenge

Late payments remain the biggest source of friction for independent landlords. After climbing steadily through mid-2025 and peaking at 13.2% in August, late payment rates have started to ease — down to 11.3% in the November forecast.

Though not as financially damaging as missed payments, a high volume of late payments adds operational stress and can complicate cash flow for landlords who rely on timely income.

2–4-Unit Properties Lead the Pack

Among different rental property types, smaller 2–4-unit rentals saw the strongest performance in November, with an on-time payment rate of 84.4%. Single-family rentals followed at 83.7%, and multifamily properties lagged at 82.5%.

All categories saw gains compared to October, pointing to a broader trend of modest recovery across the sector.

Western States Still Outperforming

Regionally, the Western U.S. remains the strongest performer for independent rental payments. South Dakota led the country with a 95.1% on-time rate, followed closely by Utah (94.5%) and Alaska (93.3%). Vermont, Virginia, and New Hampshire were the only Eastern states to break into the top rankings.

Why This Matters

Independent landlords play a significant role in the rental housing market, and their financial health is closely tied to tenant payment performance. While institutional landlords benefit from larger capital buffers, smaller operators are more sensitive to delays and disruptions in rental income.

As late payments persist, they present ongoing cash flow challenges — but rising full-payment rates suggest tenants remain committed to staying current, even if they pay late.

What’s Next?

If labor market conditions remain stable and inflation continues to cool, Chandan Economics expects on-time rent collections to gradually recover into 2026. However, the road back to pre-pandemic levels may still be long, particularly if job growth remains tepid and affordability pressures persist.

Source: CRE Daily

Accessibility

Accessibility