On-time rent collections remained down in August

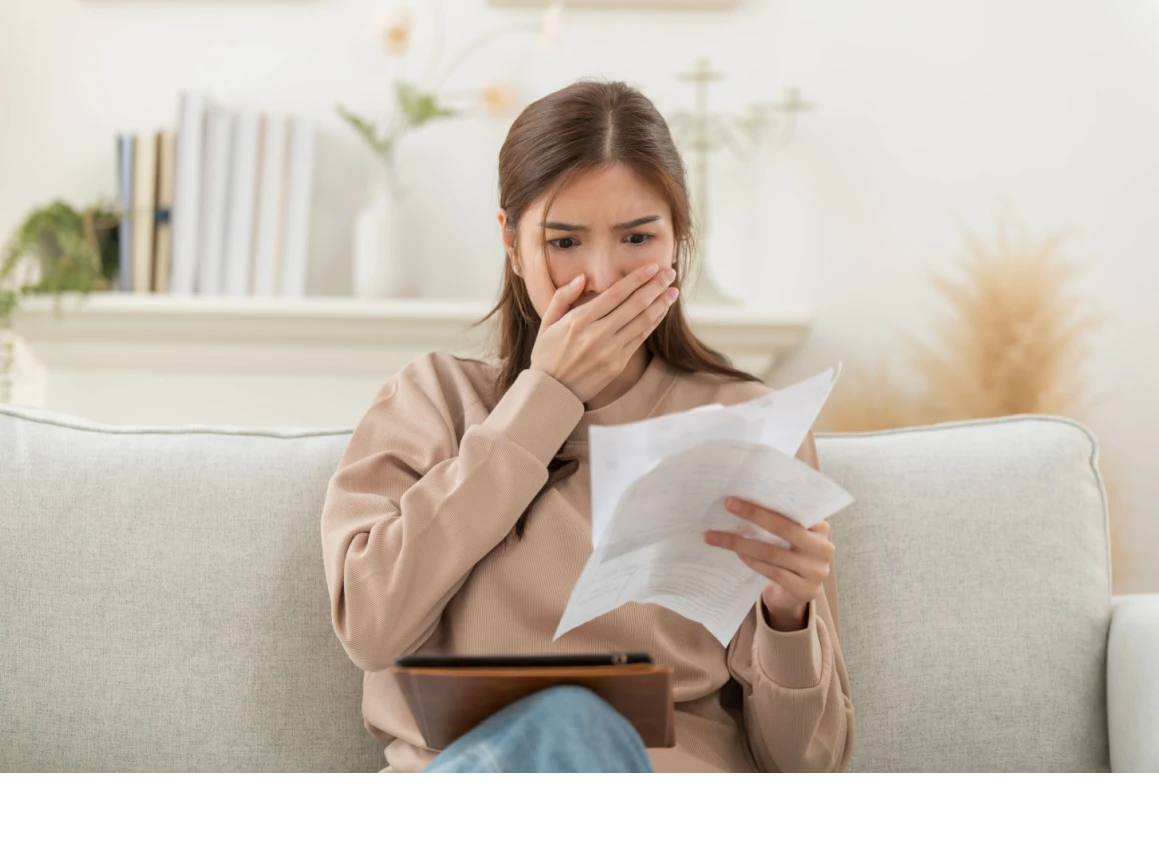

More Renters Falling Behind on Payments as Late Collections Climb

A growing percentage of apartment renters appear to be playing catch-up on their monthly bills, a trend that may signal a broader undercurrent of distress, according to a Chandan Economics analysis.

The study found that on-time rent collections remained down in August on a year-over-year basis despite a month-over-month improvement, a trend that underscores that the financial health of renter households remains under stress.

However, full collections, which include on-time and late payments, performed better, suggesting that renters are paying even if late. The three-month average of late payments in independently operated rentals has been rising consistently over the past year to 11.7% in June from a low of 8.8% in mid-2024, according to Chandan.

The analysis revealed a seasonal shift over the past couple of years. Tardiness rates tend to drop off in the spring, corresponding with the timing of many households receiving tax refunds. This may mean renters in mom-and-pop properties are sensitive to modest changes in monthly cash flow, according to Chandan.

Screen Your Tenant Today!

Gain peace of mind with AAOA’s credit, criminal, and eviction reports.

However, this year, a sustained surge in late payments without the typical springtime improvement indicates a growing share of tenants may be relying on mid-month income to pay off overdue rent, Chandan said.

Since early 2024, expenses have been rising faster than earnings after two years of income growth pulling ahead of inflation, a factor which may be contributing to shifting late payment trends, said the report.

“Compared to the early pandemic years, the income constraints felt by renters today are not as acute — nor are they as destabilizing to landlord incomes,” Chanda further explained.

“Although wages have slowed, layoffs are not accelerating significantly, helping explain why many renters are eventually meeting their rent obligations even if it’s taking longer to get there.”

Chandan’s August 2025 rent collections report found full payment rates have dropped 428 basis points since their January 2023 peak, but not as significantly as the 502 bps drop in on-time payment rates.

Rising household debt and interest costs pose an ongoing risk to renters’ ability to keep up. Non-housing debt grew by $40 billion quarter-over-quarter during the second quarter, and over the same period, the rate of debt transitioning into 90+ delinquency has climbed sharply for all age groups, the report said.

“As debt increasingly crowds out household spending on other items, renters are faced with a delicate balancing of financial priorities,” said Chandan.

“Whether renters can maintain that balance will largely depend on the short-term path of inflation, rental affordability, and the US economy’s ability to remain on the positive side of growth.”

Source: GlobeSt.

Accessibility

Accessibility