Alaska, Utah, and Montana post the highest on-time rates

Rent Payments Rebound In October 2025

Key Takeaways

- Rent payments rose to 83.5% in October, marking a second consecutive month of improvement.

- Late payments remain elevated, exceeding 10% for nine straight months in 2025.

- Full-payment rate held steady at 94.8%, showing resilience despite payment delays.

- Western states led performance, with Alaska, Utah, and Montana posting the highest on-time rates.

Modest Gains Hint At Sector Stabilization

For the second consecutive month, independently operated rentals posted a slight improvement in rent payment performance. These properties are typically managed by smaller, non-institutional landlords. October’s on-time payment rate rose to 83.5%, up nearly a full percentage point from September, reports Chandan.

Though modest, this uptick supports growing sentiment that the sector may have hit a performance floor after months of sliding collections. Revisions to September data, however, brought its on-time rate down to 82.6%, tempering some of the optimism.

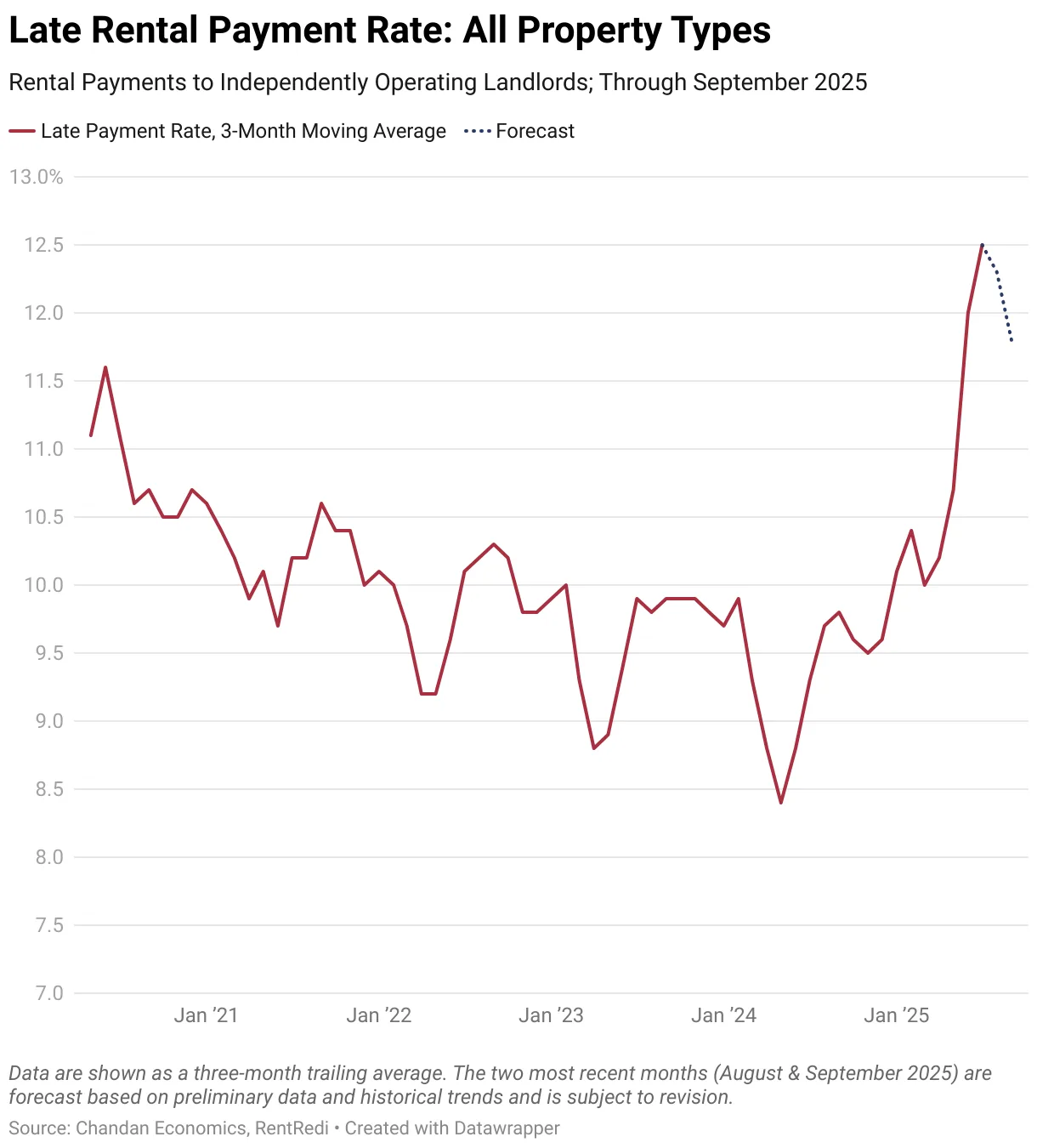

Late Payments: Still The Primary Drag

The biggest challenge facing independent landlords remains late payments. In 2023 and 2024, late payments rarely exceeded 10%. In contrast, 2025 has seen sustained pressure, with forecasted late-payment rates topping 10% for nine consecutive months — including 11.2% in October.

This delay in rent collection, while not as damaging as outright non-payment, complicates cash flow and operational planning for small landlords who often rely on consistent rental income.

Households Under Financial Pressure

Rising rent delays coincide with broader signs of household financial stress. Credit card delinquencies have more than doubled since 2021, reaching 8.6% in Q2 2025. Student loan delinquency rates have hit a record-high 13%, and auto loan defaults are also up.

Taken together, these figures reflect a growing number of renters living paycheck to paycheck — and falling behind.

Report Your Tenant’s Rent Today!

Report on-time & missed payments to Experian, Equifax, and TransUnion

Rent Still A Priority — Eventually

Despite the rise in late payments, most tenants are still paying in full, even if not on time. October’s full-payment rate — which includes both on-time and late payments — remained steady at 94.8%. Notably, recent months have seen actual payments exceed forecasts, indicating tenants’ continued commitment to making up missed rent.

On average, the 2025 full-payment rate is tracking at 96.0%, suggesting that landlords are still collecting the majority of rent owed, albeit later than desired.

Property Type And Regional Standouts

Performance varied across property types:

- 2–4-unit rentals led the pack at 84.2% on-time.

- Single-family rentals followed at 83.7%.

- Multifamily properties came in at 82.4%, despite posting the largest month-over-month gain.

- month-over-month gain.

Regionally, Western states continued to dominate. Alaska (95.1%), Utah (94.5%), and Montana (93.3%) topped the list, while Washington, DC (92.7%) and New Hampshire (91.8%) helped boost East Coast representation in the top rankings.

The Bottom Line

The October data suggests a tentative recovery in the independent rental sector. While late payments remain elevated and year-over-year declines persist, the slowing rate of deterioration and steady full-payment performance point to a sector that may be stabilizing. The road to full recovery, however, will depend on broader economic conditions — particularly labor market stability and inflation trends.

As long as job losses remain minimal and inflation doesn’t erode household budgets further, independent landlords may see continued improvement in the months ahead.

Source: CRE Daily

Accessibility

Accessibility