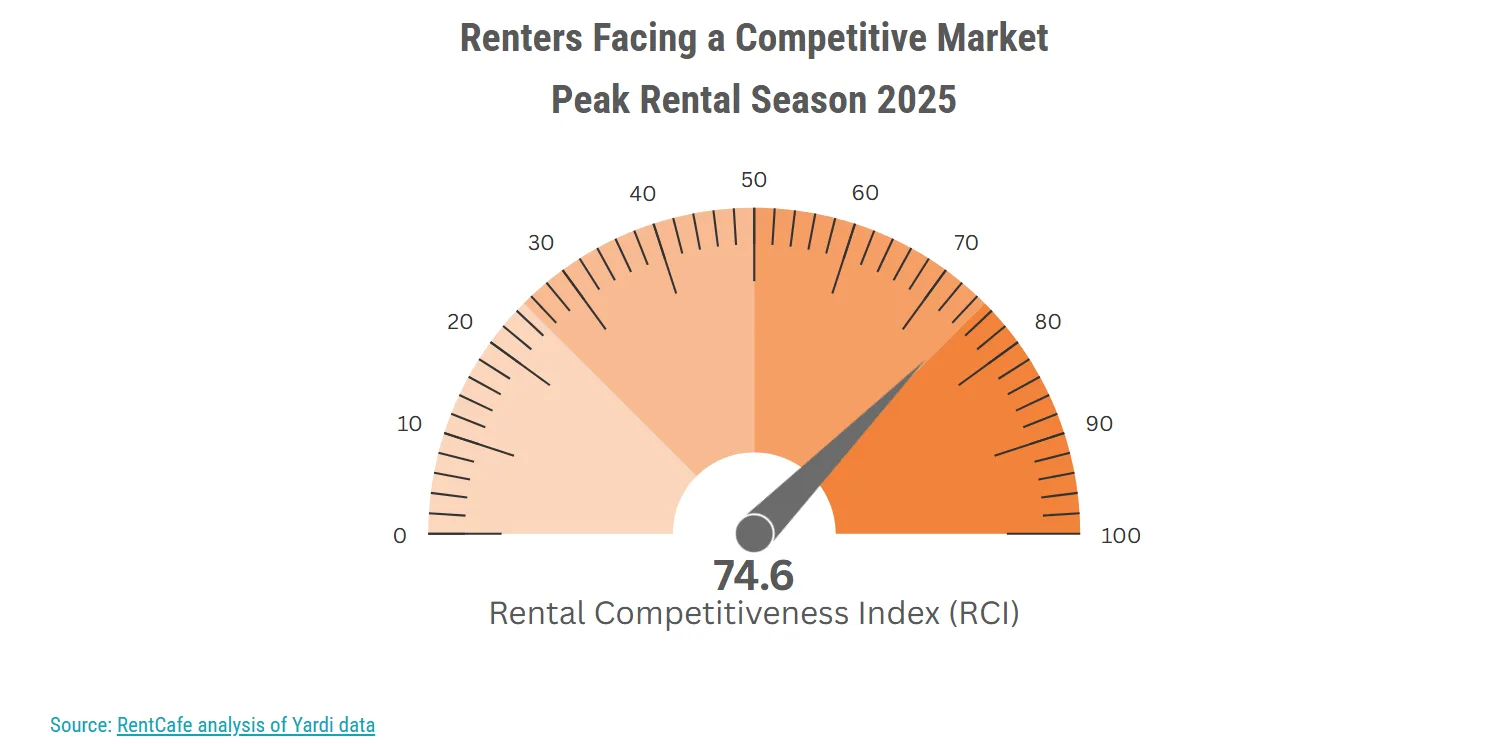

Demand soars and supply shrinks

Rental Market Competition Surges in Chicago and Miami

Key Takeaways

- Miami tops the list of the nation’s most competitive rental markets again, with Chicago right behind it.

- Chicagoland demand is surging, while construction slows, leaving renters with fewer choices.

- Midwestern markets like the Twin Cities and Milwaukee are seeing sharp competition increases.

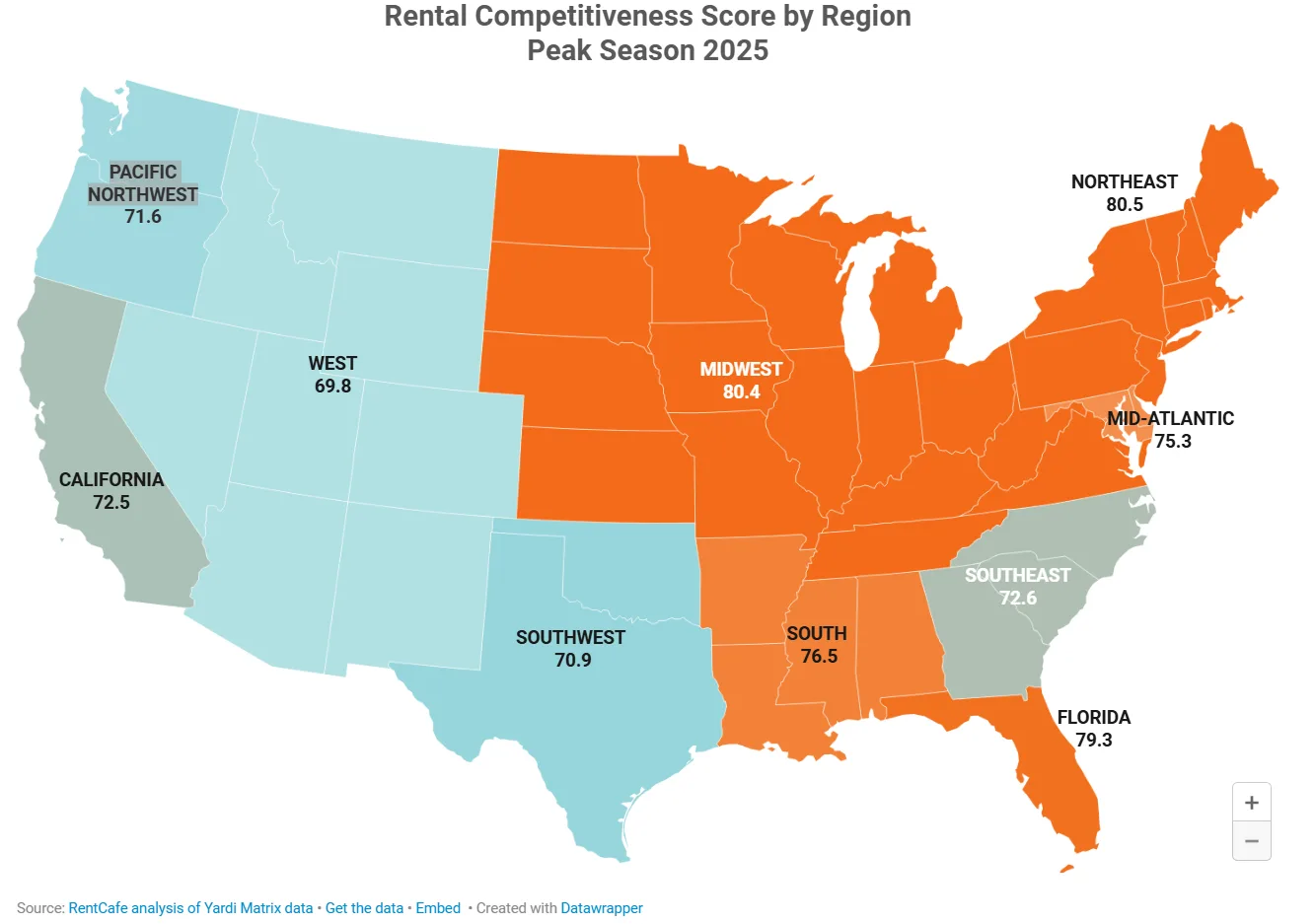

- The Northeast remains the most competitive US region, with long renter tenures and high occupancy.

Chicago’s Rental Market Tightens as Supply Drops

According to RentCafe, Chicago has become one of the most competitive US rental markets this summer. It posted an RCI score of 89, up 3.6 points from last year. Apartments now lease in just 29 days, and each vacant unit draws 16 applicants, up from 14 last summer.

New construction is slowing. Only 0.33% of housing stock comes from newly built units, down from 0.52% in 2024. That’s pushing more renters to renew their leases. The lease renewal rate rose to 60.2%, reducing available inventory.

In Suburban Chicago, the RCI dipped slightly to 88.4, but demand remains high. Vacant units now take 34 days to fill. Still, occupancy holds steady at 95.6%, and 69.7% of renters are renewing, leaving few open listings.

Miami Keeps Its Spot at the Top

Miami is once again the most competitive rental market in the US, with an RCI score of 92.2. Renters face steep competition, with 19 applicants per unit, up from 18 last year. Units lease in just 32 days, with no change from 2024.

Despite an increase in new apartments — now 1.18% of total stock — demand continues to outpace supply. Lease renewals climbed to 71.8%, pushing the occupancy rate to 96.5%.

Nearby, Broward County also remains highly competitive. Its RCI rose to 81.6, with more renters renewing and 14 renters competing per unit. In Orlando, limited new construction helped push lease renewals up to 66.8%.

Twin Cities and San Francisco See Demand Surge

Suburban Twin Cities is the fastest-rising rental market in the US this season. Its RCI jumped to 84.3, up 5.8 points year-over-year. Renewals rose to 68%, while fewer new apartments came online. Units now lease in 34 days, three days faster than last year.

Demand in San Francisco also climbed sharply. The city’s RCI increased from 67 to 72.4, driven by the AI boom and return-to-office trends. Units now attract 13 renters, nearly double the number from last summer.

Need a Lease Agreement?

Access 150+ state-specific legal landlord forms, including a lease.

The Northeast Holds the Top Regional Spot

The Northeast is the most competitive region this peak season, with an RCI of 80.5. Manhattan, with an RCI of 85.1, leads the region and ranks fourth nationwide. Vacant apartments fill in just 33 days, four days faster than in 2024.

In Brooklyn, demand remains strong, despite a drop in lease renewals. Occupancy still climbed to 96.2%, while vacant units now rent in just 36 days.

Lafayette, IN, Leads Small Market Competition

In small markets, Lafayette, IN, ranks as the nation’s tightest. It posted an RCI score of 93.8. Even though lease renewals dropped, the occupancy rate jumped to 96.9%. Each unit now draws 15 applicants, up from 11 last year.

Other hot small markets include Fayetteville, AR, and Lehigh Valley, PA, where demand remains high and available units are scarce. These markets are especially appealing to students, professionals, and renters priced out of larger metros.

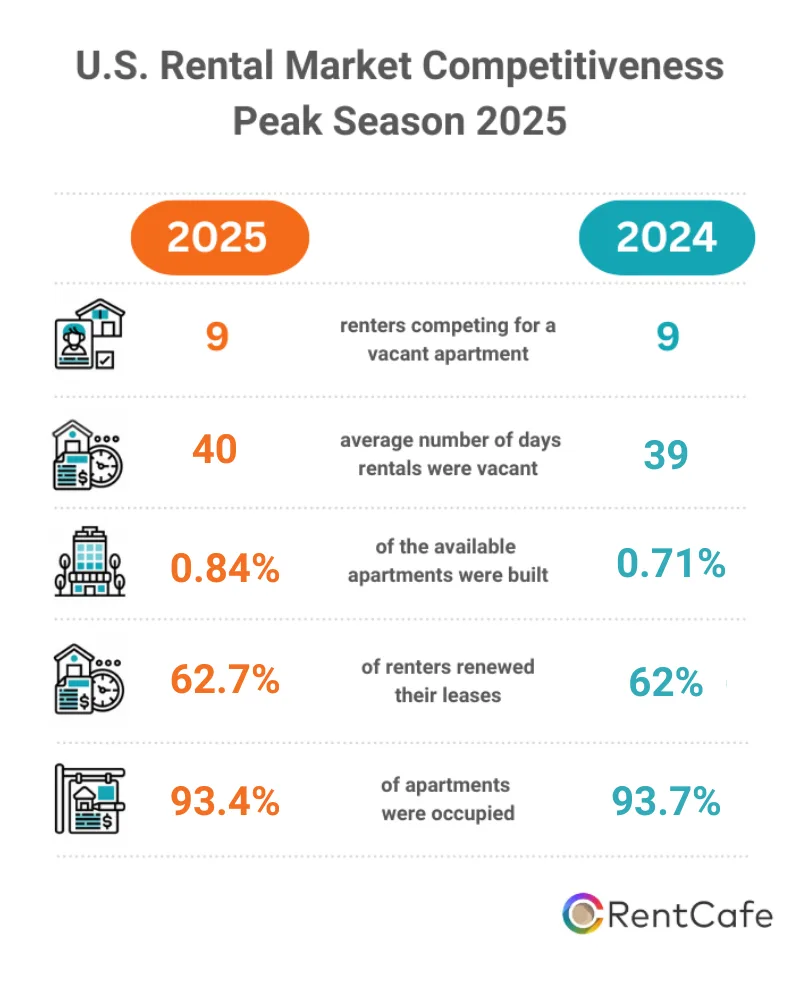

Why It Matters

Even with over 600,000 new apartments added nationwide in 2024, demand continues to outpace supply. Cities like Miami and Chicago highlight how affordability, migration, and tight inventory are creating intense competition across all regions.

What’s Next

Expect continued pressure in the Midwest and Southeast, where new supply isn’t keeping up with demand. Smaller markets like Lafayette, IN, and Lake Charles, LA, are rising fast, offering renters fewer options and driving competition even higher.

Source: CRE Daily

Accessibility

Accessibility