Despite warnings, real estate investors keep getting sucked into Ponzi schemes

Scam Ahead

Before Jonathan Gould lost everything in Pride of Austin’s alleged Ponzi scheme, he thought he’d built a $1 million nest egg. Instead his money disappeared, along with $60 million from other backers that fund founder Rob Buchanan had pulled in over a decade.

In a similar boat: 2,000 investors in Atlanta-based firm Drive Planning, who thought they’d get returns of 10 percent each quarter from real estate investments. They discovered that their money was fueling an alleged $300 million racket that netted CEO Russell Todd Burkhalter a $3.1 million yacht and $2 million condo, according to a preliminary injunction won by the Securities and Exchange Commission.

It was the same story in Washington, where some of the $230 million that investors put into local real estate investment firm iCap for Seattle-area development plans went to repaying other investors. “Fundraising new debt was the company’s business,” an attorney representing some investors told a judge, the Seattle Times reported. “Real estate development was an incidental activity.”

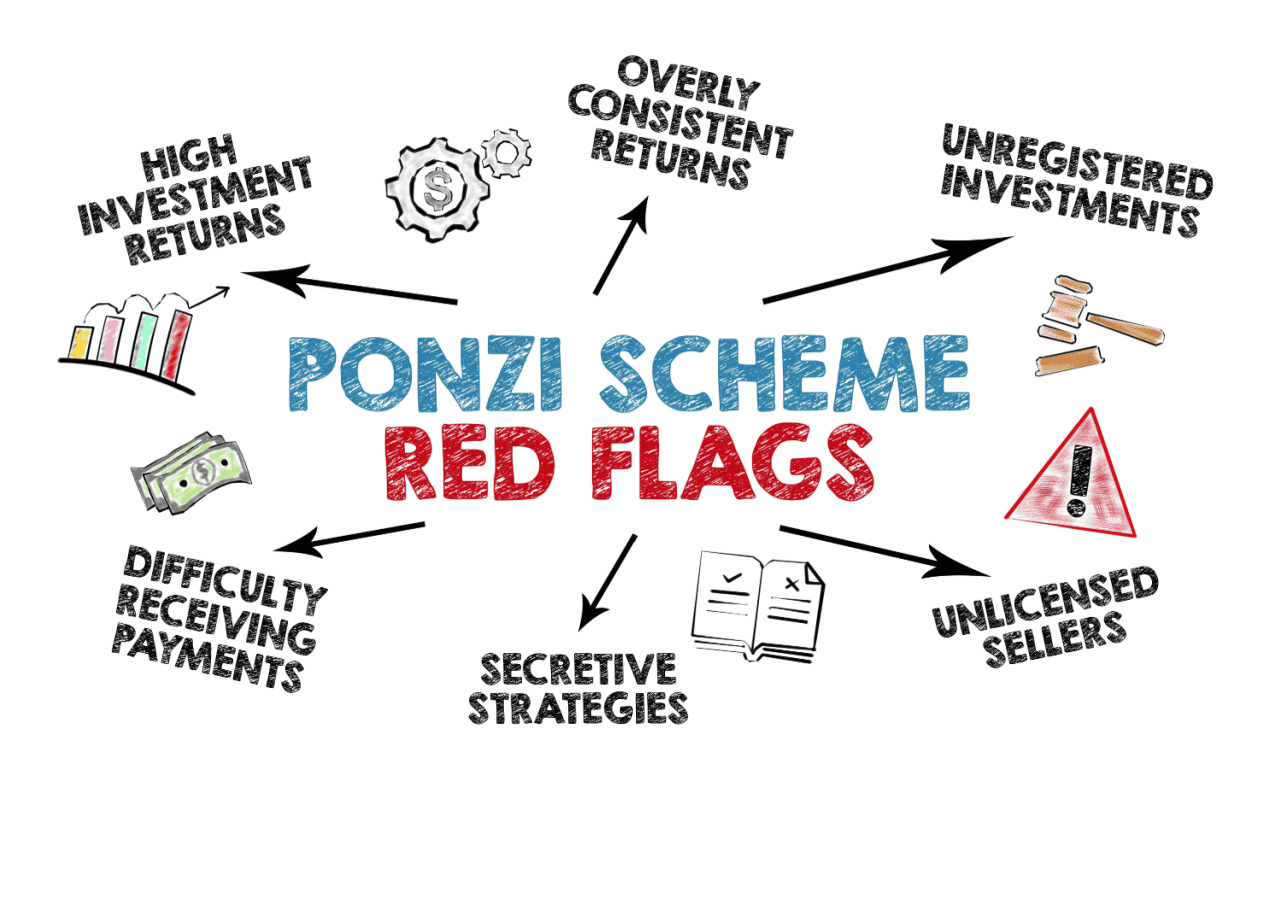

These three are just the latest in a steady drumbeat of cases running through the nation’s courts. Ponzi schemes — which pay returns to existing investors with funds from new investors rather than cash thrown off by purported investments — seem to be as much a feature of real estate as maturity dates or loan payments. Ponzi operators rope in even seasoned investors with promises of real property and guaranteed returns before cash vanishes, leaving victims’ finances devastated and diminishing trust in the industry.

It’s hard to track exactly how many Ponzi schemes occur in real estate, but the maneuver, which falls under the umbrella of investment scams in Federal Bureau of Investigation reports, is a perennial problem. The most costly type of crime tracked by the survey, they cost consumers $4.6 billion in 2023, 38 percent more than the year before, according to the FBI’s 2023 Internet Crime Report. The report does not track how often they occur in the real estate industry.

After Pride of Austin collapsed, Gould, now 67, was homeless for a period and relied on safety-net programs. He now hopes to find a full-time job, just as many people his age are entering retirement.

“I am absolutely ruined,” he said, “and I’m not being dramatic for the purpose of the interview.”

He definitely will not fall for a scheme like this again. But someone else probably will.

History of a scam

Ponzi schemes are not all alike. Some revolve around fictional investments, while others are legitimate businesses that went astray, according to Priya Sopori, a former prosecutor from the U.S. Attorney’s Office in the Central District of California who once worked on a Ponzi case with 900 victims.

Real estate provides a fertile environment for would-be Ponzi con artists. Charisma already matters a lot, with large deals hinging on nothing more than personal connections. The industry also provides a sort of camouflage for overpromising ventures, since above-board investments pitch high returns too, allowing con artists to fly under the radar even with promises of both unnaturally high returns and very low risks.

Get a Free Multifamily Loan Quote

Access Non-Recourse, 10+ Year Fixed, 30-Year Amortization

Many investing structures in the industry are also complex — “so complex that they’re difficult to explain,” Sopori, now a partner at Los Angeles law firm Greenberg Glusker, said— which can end up shielding fraud.

Take the major Ponzi case that she worked on, which resulted in a 14-year prison sentence for California businessman David Lincoln Johnson in 2012. That case involved an Inland Empire company called Financial Solutions, which promised investors returns between 5 and 20 percent per month. In less than a year, the scheme collected nearly $23 million from investors.

One of the other perpetrators in the scheme, Christiano Hashimoto, who was sentenced to 10 years in jail, offered investors the chance to take part in a “government contract lending program,” with the loans supposedly funding public sector construction. Hashimoto told investors that the investment was bulletproof because it was guaranteed by a government contract. But the government contract never existed.

The iCap case, meanwhile, illustrates how underperformance may plunge an upright company into Ponzi scheme territory. The firm, which targeted Chinese investors, only generated $1.4 million in profits, from a total of $103.4 million in real estate projects, over a 10-year period.

Fool me once

With his Pride of Austin investment, Gould felt like he had life all figured out. He parked his savings at Buchanan’s funds, then paid attention to “other things in life” beyond his “entrepreneurial interests,” he said.

“It’s easier to have somebody else vet the deals and maintain, you know, pretty much on average, what I was doing on my own,” he added.

Unlike the victims of many such schemes, Gould found Buchanan through professional networks.

“I wasn’t solicited,” Gould remembered. “I approached them and it was a gradual discussion over a number of months. I did do a little investigation on them.”

In that, Gould was unusual. Fraudsters typically target people with ready capital who lack investment knowledge, Sopori said.

That is one of the few generalizations experts will make about real estate’s Ponzi victims.

“There’s no category of people who are exempt from being victims,” Christopher Chabris, a psychologist who studies scams and is co-author of “Nobody’s Fool,” about the psychological misdirection swindlers use, said. “Different kinds of scams might work on different kinds of people.”

Gould saw this firsthand among Pride of Austin investors. “I’ve talked to a couple of people who I think have much more sizable losses than me,” he said. “And you know what? They’re sophisticated people. They didn’t get sucked into this.”

The real problem is the human brain, Chabris said.

The organ has a truth bias, meaning that we assume new information is true. “If we automatically assumed everything we were hearing was false, then we would have to go through sort of like a long process of verifying everything and checking everything before we could even speak in response to someone,” Chabris explained.

This wiring makes us vulnerable to scams but is better than the inverse, he said.

“We wouldn’t be able to live as human beings if we just disbelieved everything. Society wouldn’t work that way.”

No end in sight

Groups of investors frequently sue con artists, and federal regulators are after them too. But it’s like Whac-a-Mole, with a new scam popping up just as another slowly works its way through the courts.

The act of defrauding investors, on its own, does not immediately guarantee a criminal case.

Two factors determine whether prosecutors file a case: the amount of losses and the number of victims. “I would have (prosecuted) if there were a sufficient number of victims and if the amount in controversy, meaning the amount of issue in the investments, is going to be exceedingly high,” Sopori said.

In recent months, the SEC has gone after alleged fraudsters with massive hauls and victim headcounts. In February, Thomas Nicholas Salzano, described by the SEC as the “shadow chief executive” of New Jersey firm National Realty Investment Advisors, LLC, pleaded guilty in relation to a $658 million real estate Ponzi scheme that defrauded over 2,000 investors.

In October of last year, Nanban Ventures, which sold itself to investors as a “person you can trust,” was accused of orchestrating a $130 million Ponzi scheme that targeted the Indian-American community in the Dallas-Fort Worth area.

The regulatory wins might deter future Ponzi masterminds or spare would-be victims.

But they are little comfort to Gould.

“This has destabilized me and it’s a big adjustment to make and it’s very degrading,” he said. “It’s embarrassing at my age to have to apply for safety-net programs and then go through the humiliation of dysfunctional government systems.”

Source: TheRealDeal

Accessibility

Accessibility