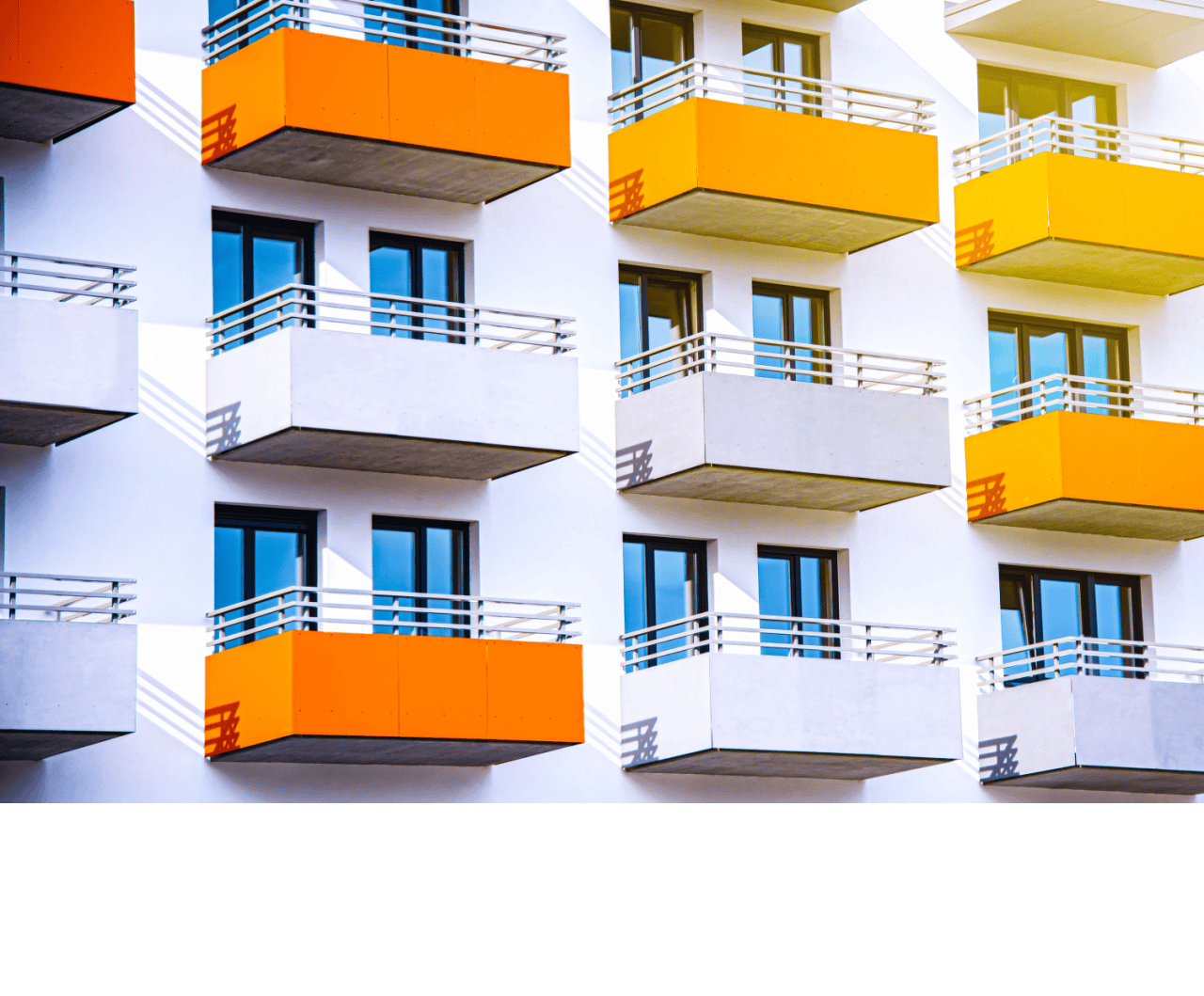

One asset class that has consistently proven its resilience through recessions is multifamily real estate

Why Multifamily Real Estate is a Recession-Resilient Investment

Investors are constantly seeking ways to safeguard their portfolios during uncertain economic times. One asset class that has consistently proven its resilience through recessions is multifamily real estate. Whether you’re a seasoned investor or exploring real estate for the first time, understanding why multifamily properties can provide stability during a downturn is crucial for long-term wealth building.

What Makes Multifamily Real Estate Recession-Resilient?

1. Consistent Demand for Housing

Housing is a basic need, and unlike other investment sectors that may fluctuate with economic cycles, people always need a place to live. During a recession, when homeownership might decline due to tighter lending standards or job insecurity, demand for rental properties typically increases. Multifamily properties—such as apartment complexes and duplexes—benefit from this shift as more people turn to renting as a cost-effective and flexible option. This consistent demand for housing helps to keep multifamily properties stable during economic downturns.

2. Diversification of Tenants

One of the key advantages of investing in multifamily real estate is the ability to diversify tenants. In a single-family rental property, if one tenant stops paying rent or moves out, the investor could experience a significant loss of income. However, with multiple units in a multifamily property, the risk is spread across different tenants, reducing the impact of any vacancies or non-payment. This not only provides a steady stream of income for the investor, but it also minimizes the risk of financial loss.

3. Easier Property Management

Managing multiple single-family rental properties can be time-consuming and challenging for investors. With multifamily properties, there is only one property to manage, which simplifies the process and reduces the amount of time and effort required. Additionally, with multiple units in one location, maintenance and repairs can often be handled more efficiently and cost-effectively.

4. Potential for Higher Returns

Multifamily real estate has the potential to generate higher returns compared to other types of investments. Not only does it provide a steady stream of passive income through rent payments, but it also offers opportunities for appreciation over time. As demand

5. Cash Flow Potential

Multifamily properties can also offer strong cash flow potential during a recession. With multiple units generating income, investors have a steady stream of cash flow even if some units are vacant or experiencing lower occupancy rates due to

Get a Free Multifamily Loan Quote

Access Non-Recourse, 10+ Year Fixed, 30-Year Amortization

6. Diversified Income Stream

Multifamily properties offer multiple units, which means the risk of income loss is spread across many tenants. Even if a few tenants vacate or experience financial difficulties during a recession, the overall income from the property remains stable. This diversification of income makes multifamily real estate less risky compared to single-family rentals, where losing one tenant can result in a complete loss of income for that property.

7. Affordability of Multifamily Units

During economic downturns, many people look to reduce expenses, and renting in a multifamily property often provides more affordable housing options compared to single-family homes. In addition, certain multifamily properties may qualify for government programs or subsidies that make them attractive for both tenants and investors.

8. Government Support and Incentives

Multifamily properties often receive government backing during tough economic times. Programs such as Section 8 vouchers and affordable housing tax credits can create consistent demand for these types of properties. Moreover, stimulus packages and other economic relief measures may provide landlords with direct or indirect financial support.

9. Lower Vacancy Rates in Economic Downturns

Historically, multifamily properties have shown lower vacancy rates during recessions. As people downgrade from homeownership or move out of more expensive rental properties, the demand for affordable multifamily housing increases. This trend supports a steady cash flow for property owners, even during economic contractions.

Multifamily Performance During the 2008 Financial Crisis

To better understand multifamily resilience, let’s examine how this asset class fared during the 2008 financial crisis. While the housing market crashed, sending home prices plummeting, the rental market—and specifically multifamily properties—experienced a rise in demand. Many individuals who lost homes due to foreclosure turned to renting, stabilizing and even increasing rental income for multifamily investors .

A study by the National Multifamily Housing Council (NMHC) found that the multifamily sector recovered more quickly compared to other real estate sectors. Apartments continued to see steady occupancy rates and rent collections, positioning them as a safe investment during the financial crisis .

How to Leverage Multifamily Investments in a Downturn

As an investor, capitalizing on the recession-resilience of multifamily real estate requires careful strategy. Here are a few tips:1. Focus on long-term cash-flow potential: Multifamily properties, especially those in high-demand areas, have the potential to generate steady and reliable income over time. By investing for the long-term, you can weather short-term market fluctuations and come out ahead in the end.

Diversify your portfolio

While multifamily properties may be considered more recession-resistant than other types of real estate, it’s still important to diversify your investments. Consider investing in different types of multifamily properties (such as luxury apartments or student housing) and in different locations to spread out risks.

Look for value-add opportunities

In a downturn, distressed or undervalued multifamily properties may present an opportunity for investors to add value through renovations. This can lead to higher rental rates and ultimately increase the property’s value.

Focus on Essential Locations

Look for multifamily properties in areas with high demand for rental housing, such as urban centers or regions with a stable employment base.

Evaluate Property Management

Ensure that property management teams are prepared to maintain high occupancy and handle tenant turnover efficiently, especially during economic slowdowns.

Multifamily real estate offers several advantages that make it a solid investment during a recession. From steady demand and diversified income streams to government support, these properties provide a level of security that many other asset classes lack. By carefully selecting and managing multifamily properties, investors can build wealth and secure cash flow, even during times of economic uncertainty.

Source: Disrupt Equity

Accessibility

Accessibility