A Guide for Multifamily Property Owners

Wildfire Risk and Resilience

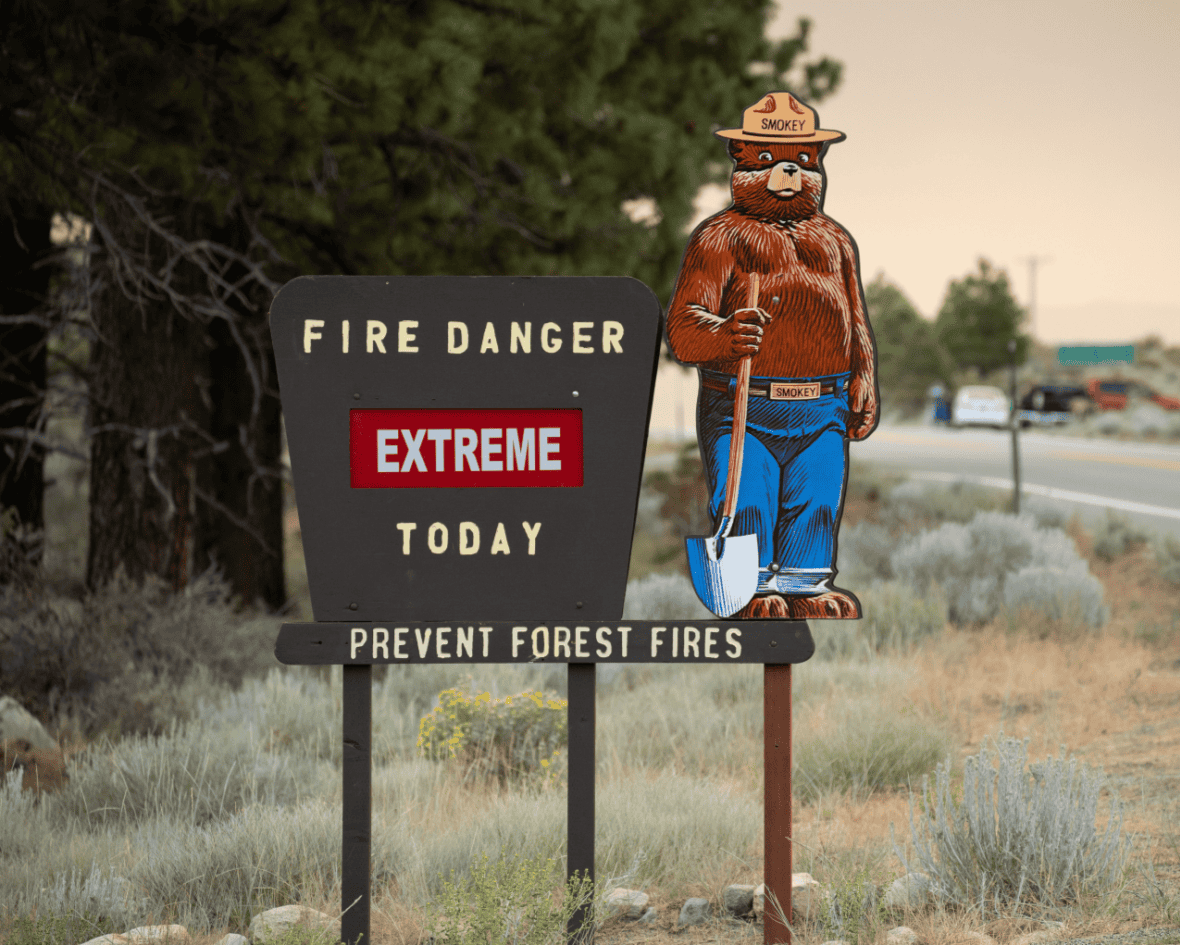

Wildfires are reshaping the landscape of property ownership and development across the U.S. Multifamily real estate owners, developers and managers are increasingly grappling with the challenges of managing properties in high-risk wildfire zones.

Rising risks demand new tools and strategies, from advanced risk modeling to innovative insurance solutions. To stay competitive and protect investments, multifamily professionals need to understand and adapt to this evolving threat.

Outlined below are key factors to consider to better protect both your investment and communities.

Wildfire risk snapshot: Regional fire challenges

California: Year-round fire seasons are the new normal, particularly in the wildland-urban junctions. Massive destruction has led to insurers pulling back, leaving many property owners reliant on the California FAIR Plan for basic coverage.

The Los Angeles wildfires are projected to result in about $30 billion in damage, but because of how insurance and reinsurance policies are structured, the financial impact on reinsurers is more like a $60 billion windstorm. This is one of the worst wildfire events in history, but it alone will not drive a hard market.

Arizona: High-risk zones such as Prescott, Flagstaff and Sedona can face a combination of fast-moving fires, dense vegetation and water scarcity, creating a “perfect storm” scenario.

Colorado: The Front Range—including Boulder, Denver and Colorado Springs—is seeing rising wildfire risks, with incidents like the 2021 Marshall Fire underscoring the need to rethink winter fire preparedness.

Beyond: Wildfires are no longer confined to the West. Regions in the Pacific Northwest and Southeast are seeing more frequent and destructive events, with drought conditions exacerbating vulnerabilities.

Paying Too Much For Insurance?

Get a FREE quote to insure your rental properties for less.

Insurance industry trends

Reconstruction costs are rising as shortages in materials and labor extend project timelines and increase payouts, putting greater financial pressure on property owners. Insurance carriers are responding to heightened risks by implementing higher premiums, policy caps and more exclusions, which makes maintaining adequate coverage more difficult.

Beyond the direct costs of rebuilding, wildfires have far-reaching impacts that disrupt operations. Road closures, tenant evacuations and supply-chain breakdowns compound the financial strain, adding new layers of difficulty for multifamily property managers. These indirect impacts are reshaping the way the industry approaches resilience and risk mitigation.

What’s changing in insurance—and how to respond

Modern technology is transforming how risks are assessed. Tools like GIS mapping, AI and climate-driven models allow for hyperlocal analysis of wildfire vulnerabilities. Property managers can now pinpoint risks, guide mitigation investments and negotiate better insurance terms using actionable data. For instance, models identifying ember zones or vegetation density help multifamily owners prioritize resources effectively.

Parametric insurance is another innovative solution that pays out based on predefined triggers, like fire intensity or proximity, rather than requiring a lengthy damage assessment, making it a faster alternative to traditional insurance.

In California, parametric insurance supplements the limited coverage of FAIR Plan policies. In Colorado and Arizona, it’s being adopted to mitigate risks tied to road closures, supply-chain disruptions and the absence of traditional insurers in high-risk zones.

Implementing parametric coverage requires working with knowledgeable brokers to define suitable triggers and integrate these policies with existing coverage to benefit policyholders.

Since insurers are raising premiums to account for wildfire risks, planning for potential cost increases is important. Risk modeling tools can help identify specific vulnerabilities for properties, allowing owners to adjust their insurance coverage accordingly.

To better protect properties from wildfire risks, owners can start by reviewing their insurance policies for any wildfire-related exclusions; sublimits, which cap payouts for specific types of losses; or restrictions on additional living expenses.

Construction and mitigation: Building for resilience

Fire-resistant materials are a foundational step in mitigating wildfire risk. Upgrading to metal roofs, ember-resistant vents and fire-resistant siding like cement can significantly reduce vulnerabilities. Additionally, innovative materials like adobe and hempcrete offer both eco-friendly and fire-resistant alternatives.

Community planning plays a critical role in wildfire prevention. Spacing buildings strategically to limit fire spread and using communal areas as firebreaks can be highly effective, and maintaining defensible space by removing vegetation and debris within 30 to 100 feet of structures further enhances property resilience.

Designing with fire safety in mind goes beyond layout. Eliminating eaves, upgrading insulation and using nonflammable exteriors create a stronger defense against ignition.

On-site water tanks and advanced sprinkler systems provide an added safeguard, while routine maintenance—such as clearing gutters and roofs—helps prevent embers from starting a fire. Emergency preparedness is also critical, and regular tenant evacuation drills and well-structured communication plans ensure safety in the event of a wildfire.

Why it matters

Wildfire risks are not going away, and there will be consequences for inaction. For multifamily property owners and managers, resilience means more than just protecting physical assets—it’s about ensuring tenant safety, operational continuity and long-term financial stability.

With advanced risk modeling, innovative insurance solutions and strategic construction practices, we have the tools to address this growing threat.

Source: Multi-Housing News

Accessibility

Accessibility