Rent prices expected to continue to drop through end of year

National Rent Dip Continues In September

The national median rent dipped by 0.4 percent in September, marking the second straight monthly decline, according to the October report from Apartment List.

In addition to the September drop, the rental market has now entered the slow season and rent prices are expected to continue to drop through the end of the year.

Fewer renters looking to move as temperatures turn cooler and the holiday season approaches the Apartment List Research Team says.

Highlights of the October report:

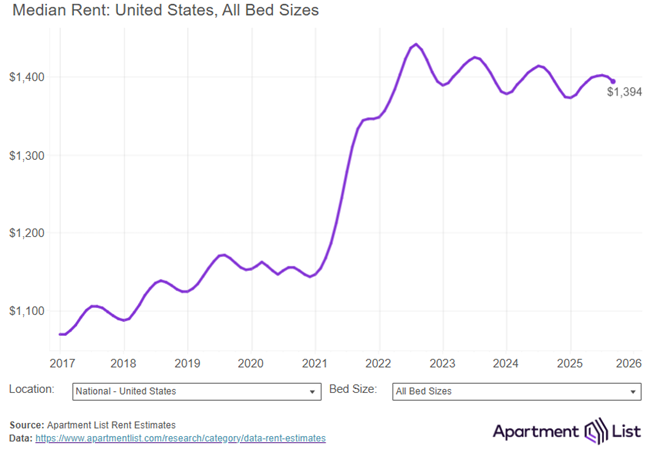

- The national median rent now stands at $1,394.

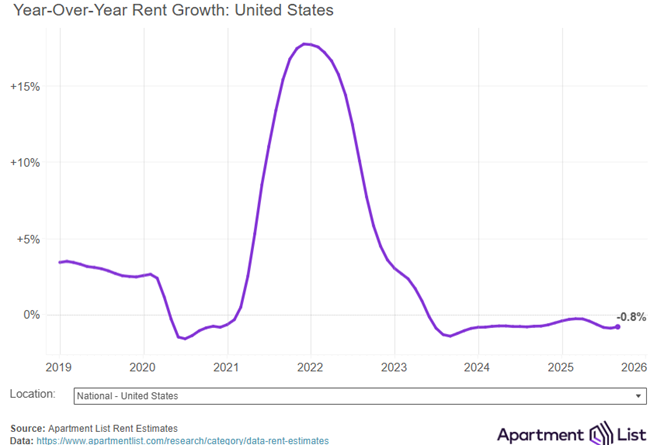

- Rent prices nationally are down 0.8% compared to one year ago.

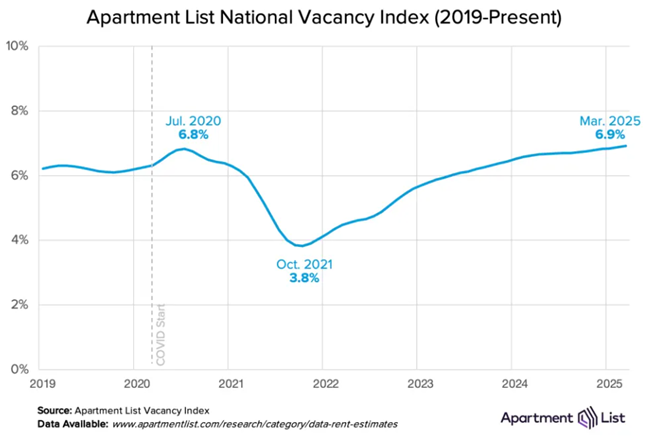

- The national multifamily vacancy rate now sits at 7.1%, a record high.

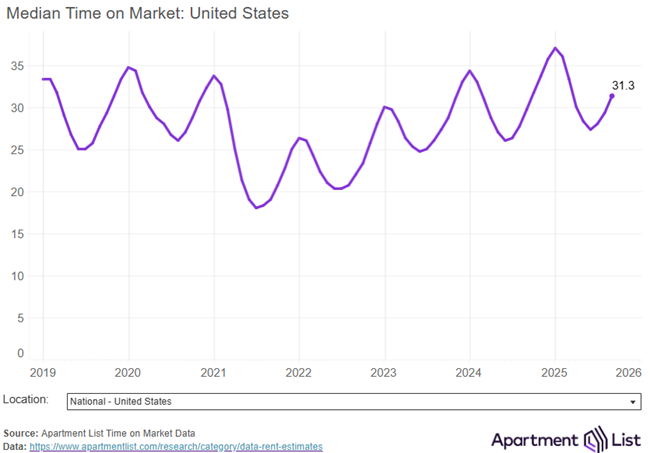

- Units are taking an average of 31 days to get leased after being listed.

“Monthly rent growth peaked at +0.6 percent in March this year, but it then began to gradually trend down during the peak moving months, when rent growth is normally fastest.

“The flip to negative month-over-month growth also came a bit earlier than what we saw in pre-pandemic years, although this is now the third straight year that prices have begun to dip in August,” the research team writes.

Multifamily vacancy rate hits 7.1%, a new peak

As more new construction apartment continue to hit the market, more vacant units are sitting on the market, meaning that property owners face more competition for renters and have less pricing leverage.

The Austin metro currently has the softest conditions among the nation’s large rental markets, with the median rent there down by 6.5% over the past year.

List-to-Lease time ticks up for third straight month

“The increasing list-to-lease time that we’ve seen recently is in line with the transition to negative rent growth as we enter the market’s off-season.

“But in addition to that seasonal trend, units are also sitting a bit longer than they typically do at this time of year, a signal of market softness in line with our rent growth and vacancy estimates,” the Apartment List Research Team writes.

Conclusion

“All of our key indicators are pointing toward ongoing sluggishness in the multifamily rental market – rent prices are down and the vacancy rate is at an all-time high.

“The outlook has been complicated by a continued influx of new units to the market and a weakening macroeconomic outlook, which could lengthen the time that it takes for the market to metabolize the recent growth in the rental stock,” the research team writes.

Source: Rental Housing Journal

Accessibility

Accessibility