Oversupply in luxury apartments leads to perks and rent discounts

Rent Concessions Surge Across Sunbelt Cities

KEY TAKEAWAYS

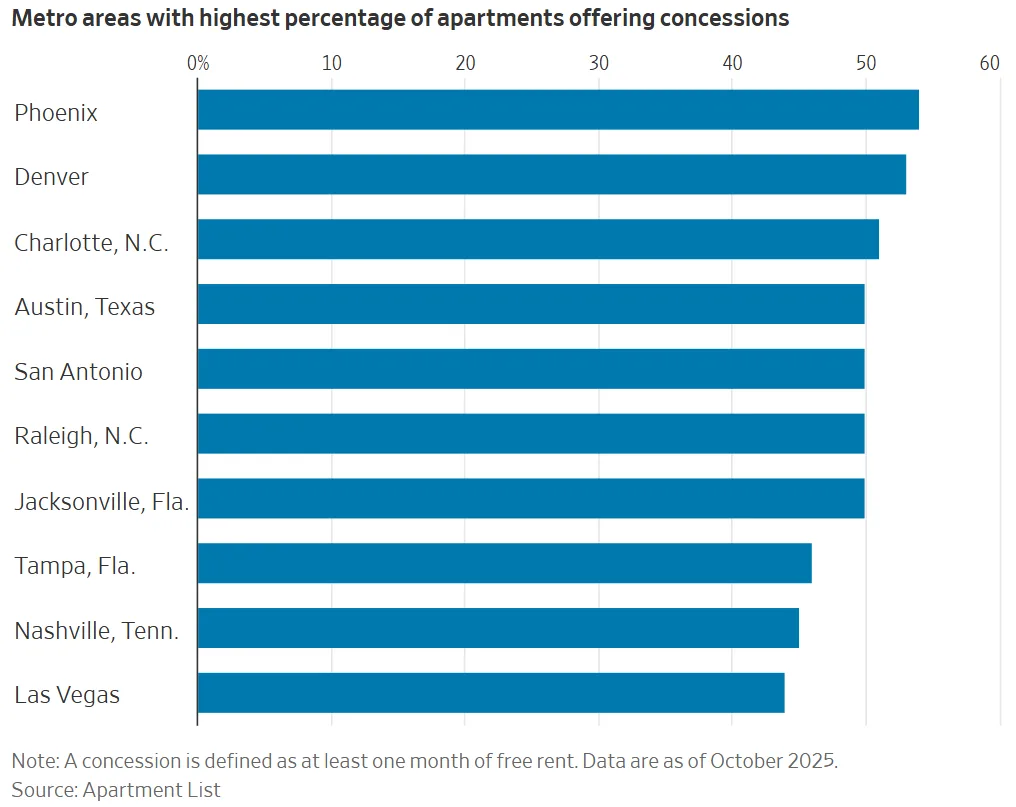

- Rent concessions trends are highest in Sunbelt cities, with Phoenix leading at 54% of listings offering free rent.

- Oversupply of luxury apartments has pushed landlords to offer benefits rather than cut base rents.

- Median rents in Phoenix fell 4% in 2025 compared to a national dip of 1.3%.

- Concessions are concentrated in new, high-end properties; lower-income renters see fewer perks.

Sunbelt Sees Rising Concessions

Landlords across the Sunbelt are ramping up rent concessions trends as newly built luxury apartments outpace demand. The WSJ reports that according to Apartment List, Phoenix leads the US with more than half its rentals offering at least a month of free rent, eclipsing other oversupplied markets like Denver and Charlotte. In contrast, renters in cities with tighter housing markets, like New York and Los Angeles, rarely see such offerings.

Oversupply Drives Discounts

The pandemic-era development boom sparked the rent concessions trend by flooding fast-growing Sunbelt metros with upscale housing. Developers targeted wealthier renters relocating from more expensive regions, but with slow absorption, excess inventory now pressures landlords to attract tenants through upfront perks including free rent months, gift cards, or event tickets. Landlords prefer these temporary deals rather than dropping asking rents, keeping valuations and advertised prices stable for investors.

Need a Lease Agreement?

Access 150+ state-specific legal landlord forms, including a lease.

Luxury Apartments Offer Most Perks

Rent concessions are most pronounced in new luxury properties, many boasting extensive amenities. For example, some buildings in Phoenix now offer up to 3.5 months free rent on multi-bedroom units. By contrast, renters of older or lower-cost apartments see far fewer concessions, as landlords maintain more pricing power with limited affordable supply. In 2025, Phoenix median rent declined to $1,350 per month, down 4% year over year.

Shifting Market Ahead

Sunbelt developers are pulling back on new construction until the current supply is absorbed. This pause could tip pricing power back to landlords within a year to 18 months, ending the generous rent concessions trend. Some analysts already point to early leasing data in 2026 that suggest concessions are beginning to shape broader multifamily trends, particularly in oversupplied metros. Renters currently benefiting from deals may soon face higher renewal rates as the market rebalances in favor of property owners.

Source: CRE Daily

Accessibility

Accessibility