BTR attracts residents seeking more space and privacy

Build-to-Rent Growth Accelerates

KEY TAKEAWAYS

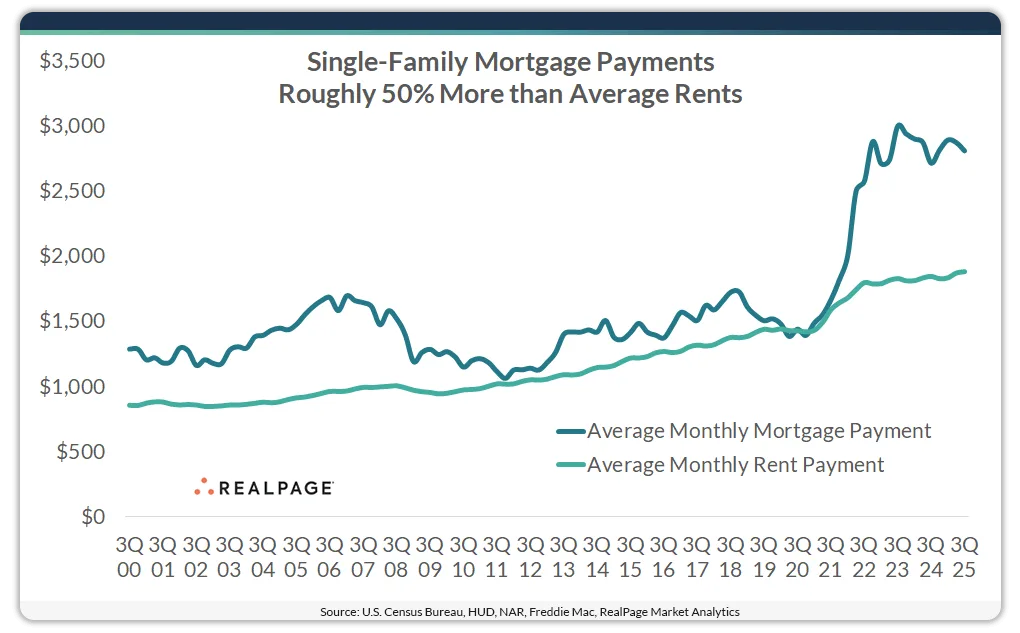

- Build-to-rent (BTR) fills a growing need as homeownership becomes less affordable.

- Average US mortgage payments now exceed rents by more than 50%.

- BTR growth is focused in the Sun Belt, with over 120,000 units nationwide.

- Sector pipeline exceeds 90,000 units, with more expansion expected in coming years.

Affordability Drives Build-to-Rent Momentum

Rising home prices and mortgage rates have widened the cost gap between owning and renting to historic levels. According to RealPage, as of 2025, the average US mortgage payment tops $2,800—about 50% more than the average monthly rent of $1,900. Property taxes and insurance make up nearly a third of mortgage costs. That added burden is pushing many consumers to choose renting over buying.

Get a Free Multifamily Loan Quote

Access Non-Recourse, 10+ Year Fixed, 30-Year Amortization

Why BTR Appeals to Renters

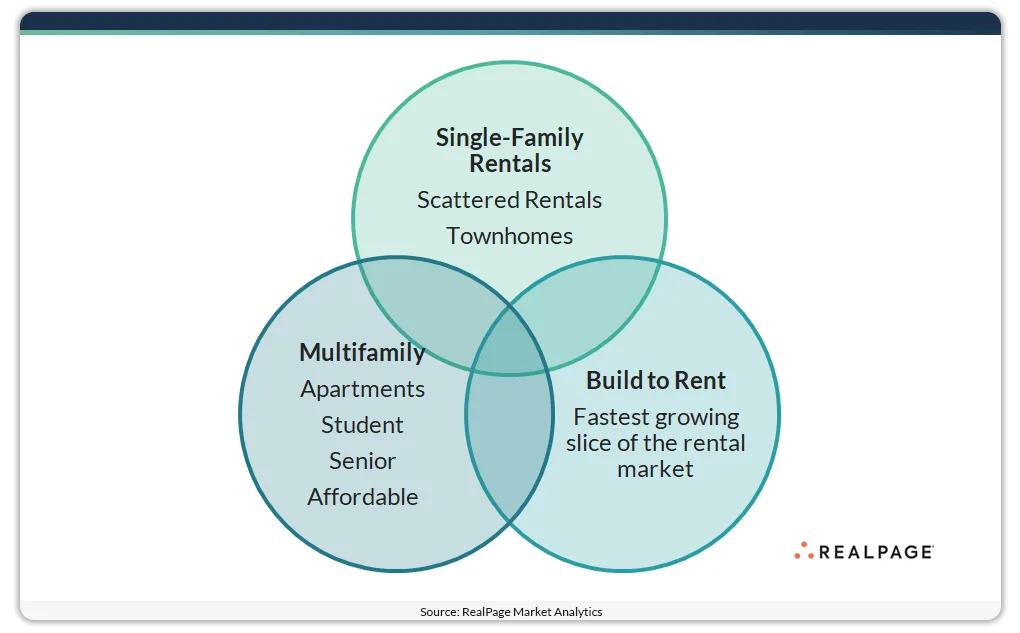

Build-to-rent offers a distinct option for renters seeking single-family living without the long-term commitment or costs of homeownership. These communities combine larger detached homes, garages, and private yards with amenities and professional management similar to multifamily properties. BTR attracts residents seeking more space and privacy, often resulting in longer rental tenures.

Market Scale and Expansion

The build-to-rent sector has taken hold nationwide, with especially deep roots in the Sun Belt. More than 120,000 BTR units are operating, and about 40,000 were completed in 2024 alone. A pipeline of at least 90,000 units points to continued growth, especially in high-absorption areas like the Southeast and Sun Belt. As leading operators scale their platforms and consolidate pipelines, the sector continues to mature into a core part of the housing landscape.

What’s Next for Build-to-Rent

Looking ahead, BTR operators plan to stabilize new projects and maintain strong occupancy and rent collections. Local market cycles continue to influence supply and rents, supporting the sector’s resilience. Developers project sustained growth in regions where BTR demand remains strongest.

Source: CRE Daily

Accessibility

Accessibility