ACA subsidy changes threaten coverage and financial stability in the housing market

Insurance Gap Hits Renters Amid ACA Uncertainty

KEY TAKEAWAYS

- Renters are almost three times more likely to be uninsured than homeowners (11.7% vs. 4.4%), and they rely more on public programs for coverage.

- Multifamily renters are better insured, while single-family renters face the highest risk of being uninsured.

- Few renters use ACA subsidies, partly due to income limits and low expectations for medical use.

- Coverage gaps increase financial stress, which may lead to missed rent payments and higher risk for landlords.

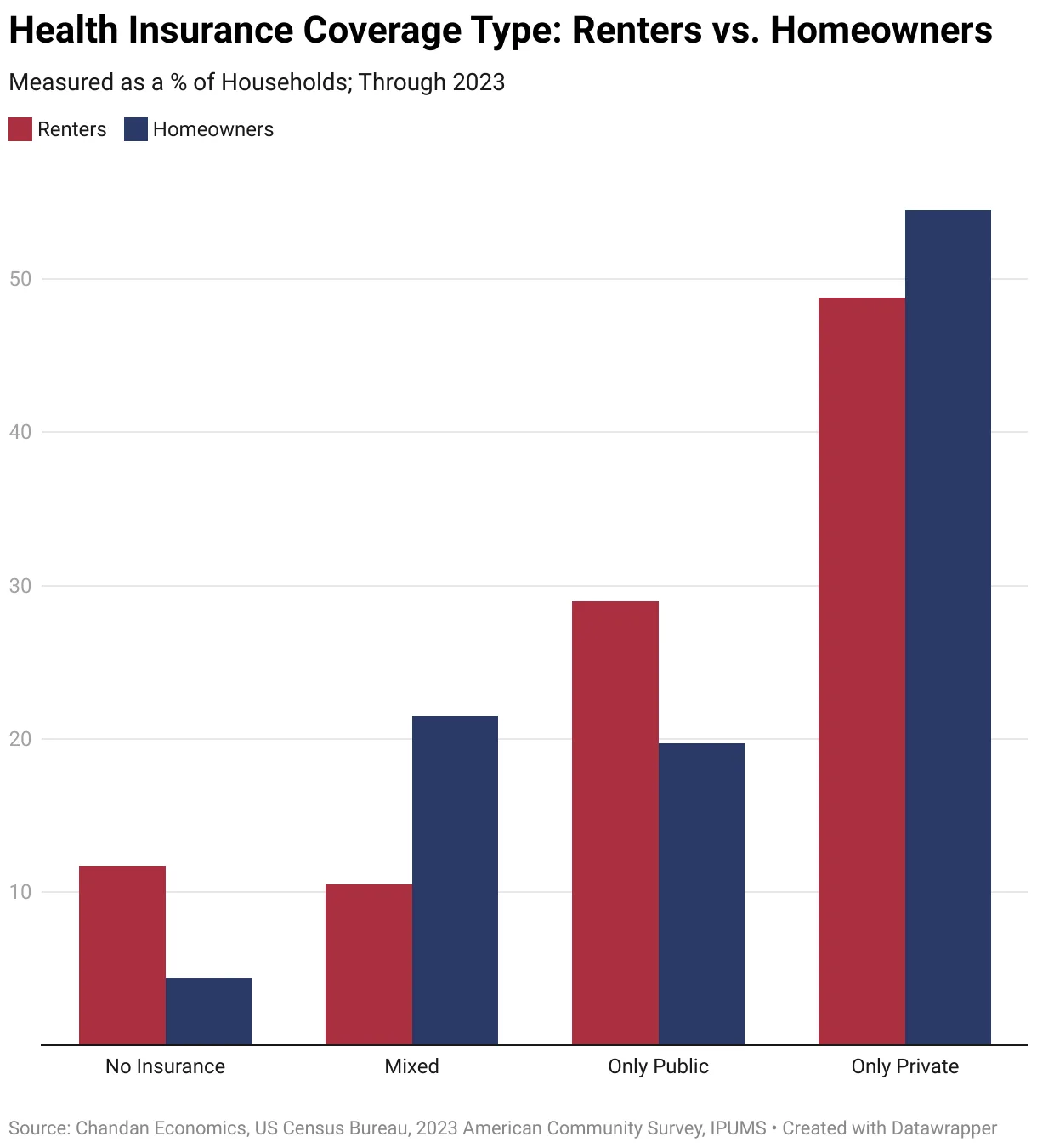

The Coverage Gap: Renters vs. Homeowners

According to Chandan Economics, when it comes to health insurance, renters are falling behind. Nearly 12% of renter households have no coverage, compared to just over 4% of homeowners. In addition, renters are less likely to have private insurance and more likely to depend on public programs like Medicaid.

Moreover, homeowners benefit from mixed coverage more often. About 21.5% of them have a mix of private and public insurance, while only 10.5% of renters do. This is likely because homeowners tend to be older or live in multi-adult households, where one person may have employer insurance and another may qualify for public help.

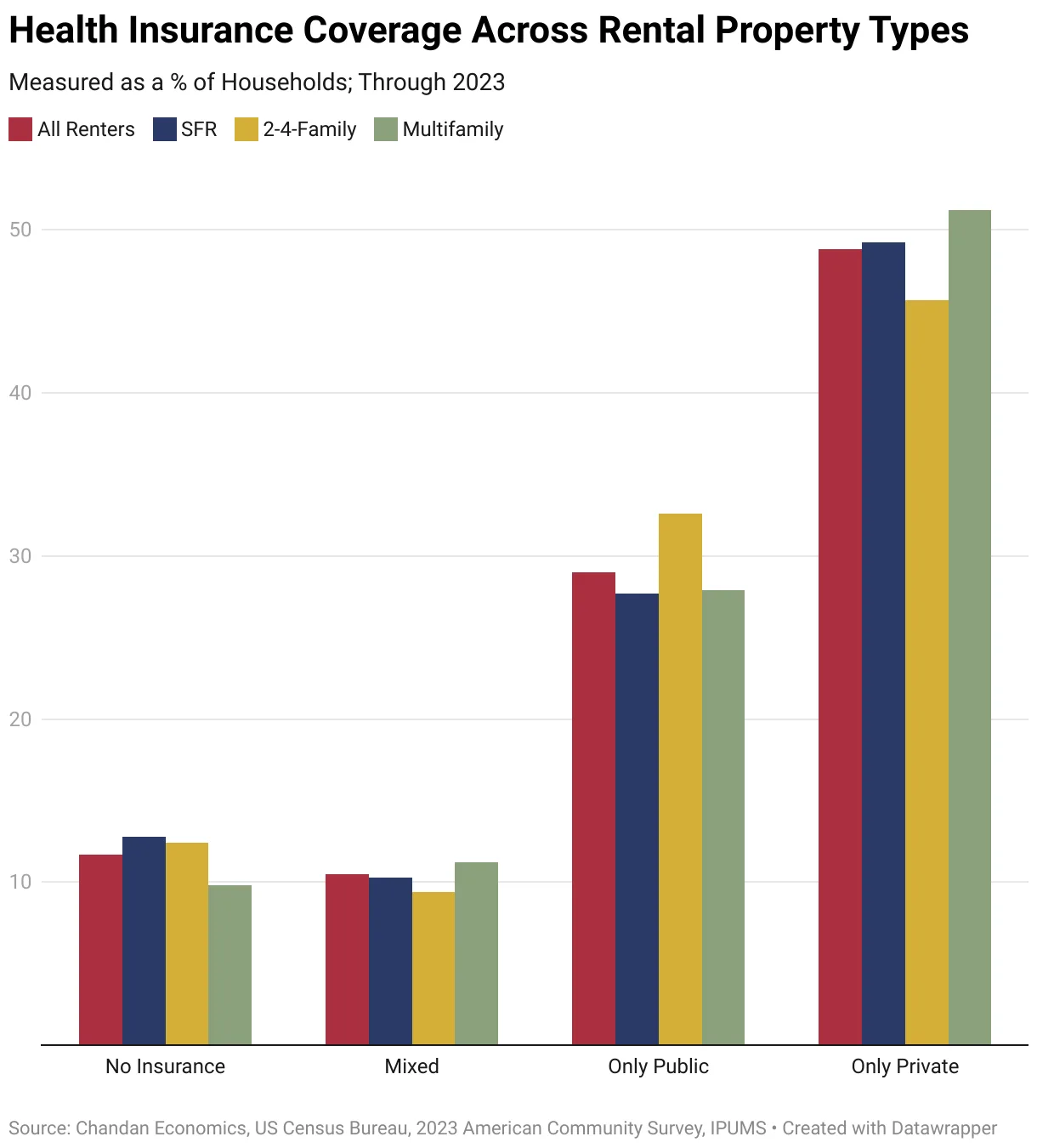

Rental Type Matters

Not all renters face the same risk. In fact, coverage rates vary based on the type of building they live in:

- Multifamily renters have the best coverage, with 51.2% holding private insurance and only 9.8% uninsured. These renters often live in cities, where job access—and employer-provided plans—is better.

- Single-family renters are worse off. Just 49.2% have private insurance, and 12.8% are uninsured—the highest among all groups. These households often live in lower-density areas with fewer health care or job benefits.

- Renters in two-to-four-unit buildings fall somewhere in the middle. They rely more heavily on public insurance (32.6%), which aligns with their typically lower incomes and older housing stock.

Paying Too Much For Insurance?

Get a FREE quote to insure your rental properties for less.

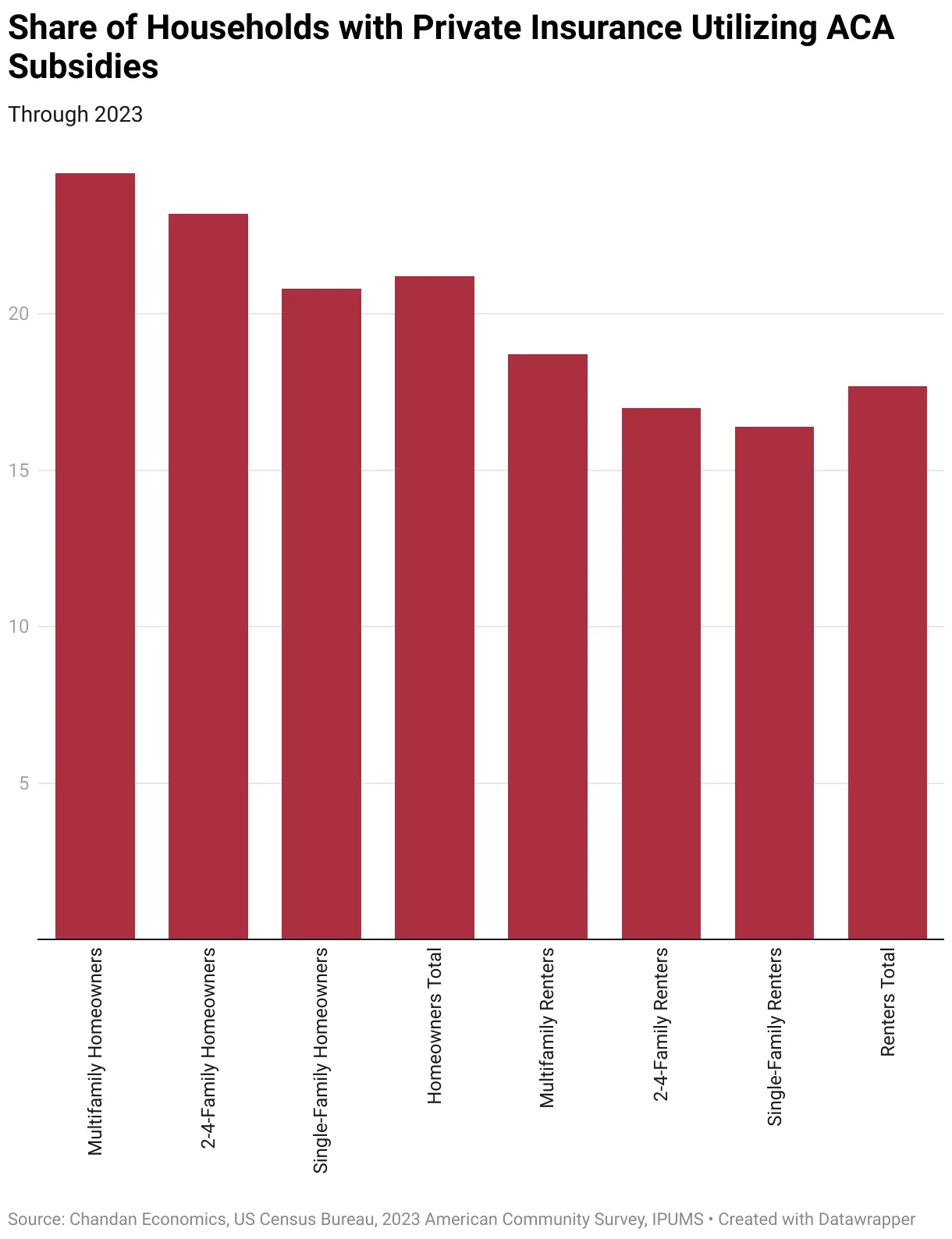

ACA Subsidies: Limited Help for Renters

While subsidies through the Affordable Care Act are available, not many renters use them. Only 18% of privately insured renters get financial help, compared to 21% of homeowners. Even within rentals, the numbers remain low—ranging from 16% for single-family renters to 19% for those in multifamily units.

There are a few reasons for this:

- Affordability limits: Many renters earn too much for Medicaid but still can’t afford ACA premiums, even with some help.

- Low usage expectations: Younger renters often expect not to use health care much, so they skip coverage entirely—even if they qualify for subsidies.

As a result, subsidy use is lower than one might expect based on income levels alone.

What This Means for Real Estate

For property owners and operators, these insurance gaps matter. Renters with no or unstable health coverage are more likely to face unexpected bills. This can quickly lead to tighter monthly budgets, making it harder to pay rent on time.

If federal support for ACA subsidies is disrupted—such as during a government shutdown—renters on the edge could lose coverage or face higher costs. This would likely increase financial stress, especially at the lower end of the rental market.

Therefore, operators should take a closer look at how health coverage affects their residents. They can reduce risk by:

- Watching for changes in health policy,

- Offering flexible rent payment options, and

- Partnering with community groups to help residents sign up for coverage.

These simple steps could help protect both tenants and rent rolls in uncertain times.

Source: CRE Daily

Accessibility

Accessibility