On-time rent payments rose to 83.1% in September 2025

On-Time Payments Improve for Mom-and-Pop Rentals

Key Takeaways

- On-time rent payments rose to 83.1% in September 2025 — a 58 bps month-over-month increase.

- Despite the gain, on-time payment rates have declined year-over-year for 26 consecutive months.

- Tenants are prioritizing catching up on rent, with full-payment rates proving more resilient than on-time payments.

- 2–4-unit properties led all asset types with the highest on-time collection rates at 83.7%.

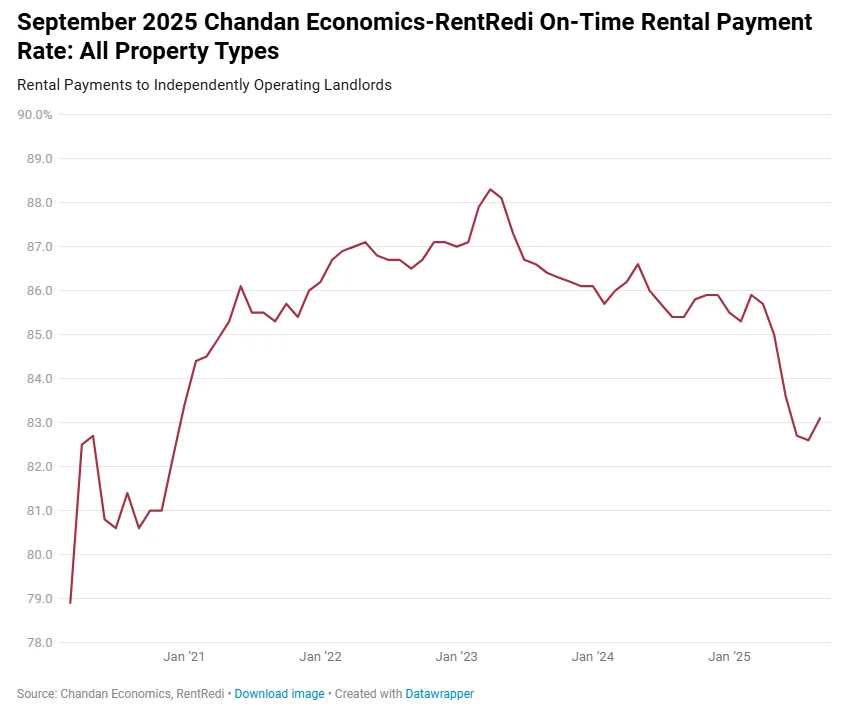

Improving, But Still Below Peak

The latest data from Chandan Economics shows a slight improvement in rent collection across the independent landlord sector.

September’s on-time payment rate climbed to 83.1%, up from a downwardly revised 82.6% in August. The gain marks a potential turning point, though it’s too early to call a full recovery.

Tenants Catching Up, Even If Late

While late payments are on the rise, full-payment rates remain relatively stable. The forecast full-payment rate for September reached 94.5%, a 14 bps gain from August. This suggests tenants may fall behind, but are still making an effort to settle balances eventually.

Still, full-payment performance is below historical norms. The year-to-date average is 96.2%, compared to 96.6% in 2023 and 95.3% in 2024.

Screen Your Tenant Today!

Gain peace of mind with AAOA’s credit, criminal, and eviction reports.

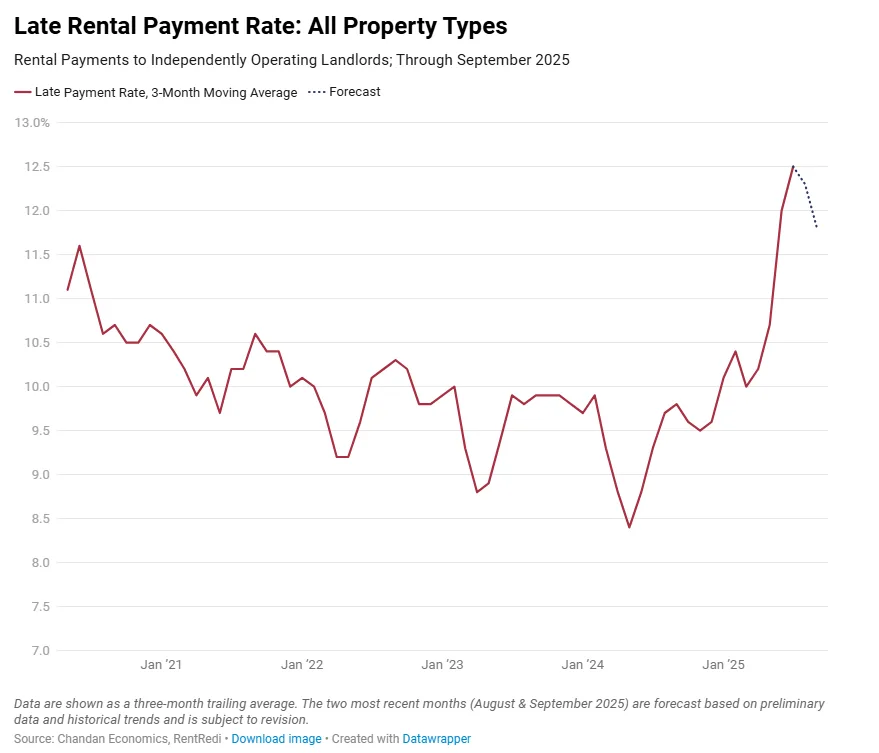

Late Payments Rising

Late payments have become a consistent drag on rental performance. The share of late payers peaked at 12.5% in July and remained elevated in August (12.3%) and September (11.8%). While not as damaging as outright missed payments, these delays complicate cash flow planning for small landlords.

Sector and State-Level Insights

By Property Type:

- 2–4-unit rentals: 83.7% on-time

- Single-family rentals (SFR): 83.3% on-time

- Multifamily rentals: 81.7% on-time

By State:

- South Dakota: 94.9%

- Hawaii: 94.6%

- Utah: 94.1%

- Other strong performers include New Hampshire (91.4%) and Colorado (91.1%).

These state-level performances reflect ongoing regional disparities, with Western markets continuing to outperform most others.

Broader Economic Context

The overall rent payment performance remains below the April 2023 post-pandemic high of 88.3%. Credit data shows mounting household stress:

- Credit card delinquency rates hit 8.6% in Q2 2025 — more than double the rate in late 2021.

- Student loan delinquencies have spiked to 13.0%, an all-time high, disproportionately affecting younger renters.

Despite this, full-payment rates suggest that most tenants still prioritize rent once they’re able.

Looking Ahead

While far from a full recovery, the September data hints at stabilization in the mom-and-pop rental sector. If job losses remain limited and inflation stays in check, Chandan expects modest improvements in on-time payment rates to continue.

The sector’s resiliency hinges on economic stability and tenant income growth — especially as affordability remains strained across much of the rental market.

Source: CRE Daily

Accessibility

Accessibility