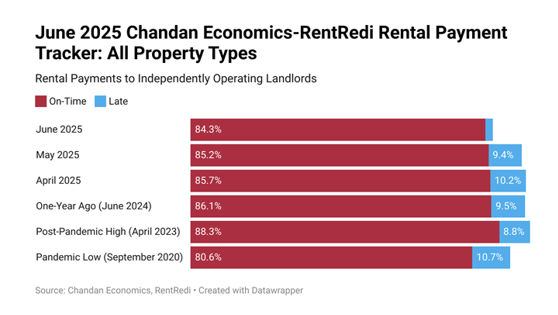

A gradual but steady erosion in on-time payment performance

On-Time Rent Payments Continue to Decline

The national on-time rent payments rate continues to show signs of strain for independent landlords, according to the June 2025 Chandan Economics & RentRedi report.

The report documented three consecutive months of decline, adding to a gradual but steady erosion in on-time payment performance.

“On-time rent payments in independently operated units dropped meaningfully in June 2025 — offering a stark warning about the financial health of renter households in a high-uncertainty economic environment. According to this month’s first estimate, 84.3% of units paid their full rent on time — a decline of 85 basis points (bps) from May.

“Additionally, May’s on-time payment rate, initially reported at 85.5%, has been revised down to 85.2%. In total, the on-time rate has declined by 154 bps over the past three months.

Year-over-Year Decline Of On-Time Rent Payments

Compared to a year earlier, the rate is down a sizable 171 bps — the steepest annual drop since April 2024.

Most notably, year-over-year on-time rent payment rates have now declined for 23 consecutive months.

Screen Your Tenant Today!

Gain peace of mind with AAOA’s credit, criminal, and eviction reports.

Key takeaways from the on-time rent payments report

- In June 2025, the on-time payment rate in independently operated rental units fell by 85 basis points (bps), dropping to 84.3%.

- On-time payment rates have fallen year-over-year for 23 consecutive months.

- The forecast full-payment rate fell to 94.0%, marking a new post-2021 low.

- Western states continue to hold the highest on-time payment rates in the country, led by Montana, Utah, Hawaii, Alaska, and Idaho.

- Two- to four-family rental properties held the highest on-time payment rates in June, coming in at 84.6%.

Why the report is important

The Independent Landlord Rental Performance report provides valuable insights into how well non-institutional landlords are managing rental payments. It uses data from property management software RentRedi, showcasing results from 73,502 units.

Information is collected and reported monthly by Chandan Economics. The trends highlighted here can serve as a benchmark for investors, brokers, and policymakers to understand the health of independent landlords in the rental market.

Source: Rental Housing Journal

Accessibility

Accessibility