According to a new in-depth study by the National Apartment Association (NAA)

Top 4 Uncertainties Facing the Rental Housing Industry

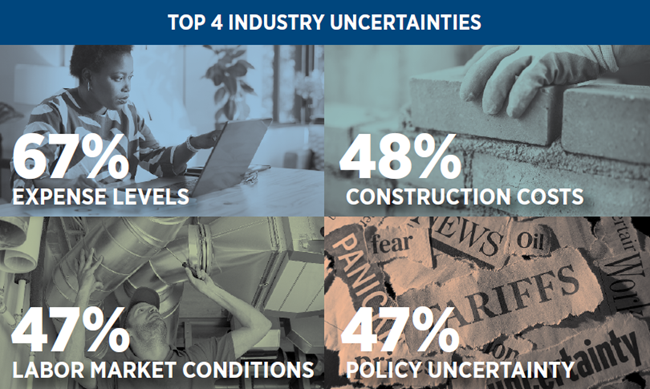

The top four uncertainties facing the rental housing industry are set out in a new in-depth study by the National Apartment Association (NAA) that shows how operators across the country are navigating them.

The apartment industry is facing a complex landscape marked by economic uncertainties, technological disruptions, and evolving regulatory environments across the country.

The findings reveal these key insights about the top four industry uncertainties facing rental housing.

No. 1 – Expense levels

During the past 12 months, expense levels emerged as the most pressing operational challenge, outpacing interest rates and labor issues, with 67% of survey respondents rating rising expenses as a highly significant issue that has affected business operations.

These findings underscore the broad inflationary pressures on line-item costs such as materials, repairs, ongoing maintenance and vendor contracts. Companies are facing increased difficulty in maintaining profitability amid rising baseline operational costs.

No. 2 – Construction costs

Due to consistent labor shortages, supply-chain disruptions, extended project timelines and inflationary pressures, 48% of respondents believe that construction costs are second in severity of the challenges currently facing the industry.

The impact reflects the deep interconnectedness between macroeconomic trends and development feasibility.

No. 3 – Labor-market conditions

In the survey, 47% of respondents believe that labor-market conditions are highly significant, as operators have faced challenges finding skilled talent despite increased employment growth. Interest rates are a key concern, with 45% of respondents rating them as highly significant.

This indicates that while interest rates remain a central pressure point, staffing constraints and regulatory ambiguity are weighing more heavily on business operators.

No. 4 – Policy uncertainty

Policy uncertainties, including active and proposed tariffs, federal funding volatility, and shifting regulatory reforms at the state and local levels, continue to weigh heavily on operator decisions.

Here are more survey details from the respondents in the NAA study:

Interest rate shifts

The impact of higher rates is felt nationwide and across the property-value spectrum, affecting both large corporate entities and individual rental owners and operators. Interview participants highlighted several headwinds stemming from higher interest rates, including delayed acquisitions and a pause on new development projects.

Construction costs

There is a clear divide between those actively adapting to construction-cost pressures and those deferring action because of uncertainty or strategic misalignment.

Among active respondents, strategies span from contract renegotiation and value engineering to delayed execution and internal planning.

Those who remain inactive often do so intentionally, with valid operational or investment priorities elsewhere. As cost pressures persist, more firms may shift from passive observation to active preparation.

Labor-market challenges

Changes in the labor market over the past year have affected apartment owners and operators. Despite continued employment growth, companies emphasize that finding skilled talent remains both a priority and a challenge.

The survey results indicated that labor-supply challenges pose a greater threat to multifamily housing operations than wage increases. Sixty percent of survey respondents identified labor shortages as more disruptive than rising compensation costs. The inability to secure reliable, skilled labor – particularly in maintenance, repairs and other front-line roles – is straining operational capacity and elevating turnover risks.

Centralization

Centralization was not broadly perceived as a major disruptive force to operations in the current market environment. Only 11% of respondents rated it as a highly significant challenge. This suggests that while many firms are pursuing centralization for strategic efficiency or experimenting with centralized models, it has not created widespread operational friction in the rental housing industry.

Single-family versus multifamily

The responses revealed a varied and shifting landscape. Some industry professionals focus only on multifamily buildings, while others manage only single-family properties. And some larger firms own and manage a combination of both. The interviews highlighted a growing demand for both types of rentals with a renewed focus on affordability.

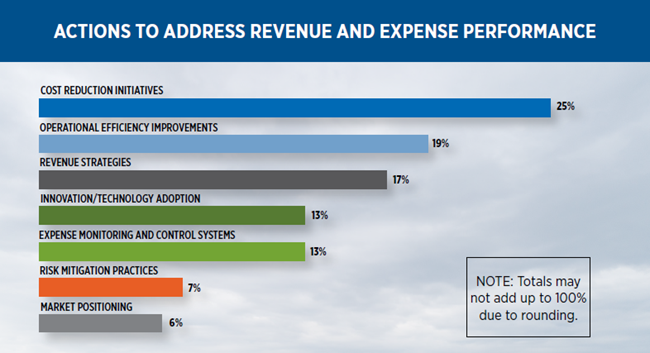

Revenue impact

For many professionals, rent growth has been moderate over the past year. In some cases, companies are resorting to concessions or rent reductions to either retain or attract renters. Respondents emphasized the importance of having strong rent-collection systems in place, including automation strategies.

Looking ahead, operators identified regulatory changes and pricing limitations as the biggest looming threats to their revenue strategy. Sixty-eight percent saw regulatory uncertainty as a moderate to severe risk, while 73% identified pricing limitations (e.g. rent control, market caps) as a major threat.

Fraud and bad debt in the rental housing industry

Fraud and bad debt have become more than routine nuisances; they are now recognized as persistent operational threats. Industry participants in NAA’s interview panel stated that fraud and bad debt are both rising concerns and challenges, especially with the technological advances of artificial intelligence.

On the fraud side, concerns are focused on the application process, where fake income documents, identification forms, credit history and other documents are much easier to create with AI.

About the survey:

The NAA study and survey about uncertainties facing rental housing, sponsored by MRI Software and conducted by the NAA, approached the research study with a two-pronged methodology. One prong involved fielding a survey of senior-level real estate professionals, collecting insights and information from more than 350 respondents across the industry. The other prong consisted of a series of in-depth interviews with C-suite and Independent Rental Owners (IRO) to uncover deeper concerns and provide more detail about the ways in which the industry is responding to current challenges.

Source: Rental Housing Journal

Accessibility

Accessibility